News Round-Up, August 24, 2023

Thanks to all for the amazing support... 106K on Twitter in the last 28 days...

Picture of the day...

Most read…

How Oil and Tech Giants Came to Rule a Vital Climate Industry

Generous government support helps carbon removal play a crucial role in neutralizing emissions

WSJ by Amrith Ramkumar, Aug. 24, 2023 Opinion: India’s brilliant moon landing illuminates Russia’s drastic decline

TWP by David Von Drehle, Deputy opinion editor and columnist, August 23, 2023 Who won, who lost and who fizzled in the first Republican debate

Ron DeSantis was a non-factor as Republicans piled on Vivek Ramaswamy, instead.

By POLITICO STAFF, August 24, 2023Washington drafts proposal for Venezuela's oil sanction easing

Reuters by Marianna Parraga, Vivian Sequera and Timothy Gardner, August 24, 2023All eyes are now on the Federal Reserve

US economy has remained unexpectedly robust – but markets could be volatile again

The Telegraph, TOM STEVENSON24 August 2023The AES Corporation is committed to accelerating the future of energy transitions by delivering greener and more innovative solutions. AES firmly believes that energy infrastructure plays a crucial role in ensuring the sustainability of our sector. Recently, the AES President and CEO, Andrés Gluski, had the privilege of moderating a captivating discussion titled "Harnessing Diplomacy for the Energy Transition and Universal Access" at the @EEI_Intl panel. This engaging conversation highlights the importance of collaboration and innovative approaches in driving the energy transition forward.

Climeworks deploys a carbon-removal technology known as direct-air capture and sells carbon credits to big companies. PHOTO: ARND WIEGMANN/REUTERSHow Oil and Tech Giants Came to Rule a Vital Climate Industry

Generous government support helps carbon removal play a crucial role in neutralizing emissions

WSJ by Amrith Ramkumar, Aug. 24, 2023 The technology to remove carbon from the atmosphere is unproven at scale and the economics are just taking shape. What has become clear this year is that carbon removal is now the realm of giant companies and big government support.

The Energy Department this month committed $1.2 billion to create two carbon-removal hubs in Texas and Louisiana, home to a large portion of the U.S. fossil-fuel industry. The biggest competitor in the Texas project will be Occidental Petroleum, which has its own billion-dollar bet on the technology.

Three deals this year cemented corporate involvement in the sector: Exxon Mobil is buying one of the biggest operators of pipelines that move carbon to sites where it can be stashed underground; Occidental is buying one of the two most established carbon-removal technology companies; and the other experienced carbon-removal startup completed the first third-party verified process and cashed in on it by selling carbon credits to Microsoft and other big companies.

Climeworks has created a giant vacuum cleaner to capture carbon dioxide from the air, helping companies offset their emissions. WSJ visits the facility to see how it traps the gas for sale to clients such as Coca-Cola, which uses it in fizzy drinks. Composite: Clément Bürge

The most prominent carbon-removal technology favored by the government, Occidental and these startups is called direct-air capture. It employs vacuum-like devices and fans to suck in air, pull out the carbon and bury it underground. The process is a man-made variation of what trees do every day.

It differs from carbon capture, which grabs carbon from smokestacks. This effort is considered easier because those emissions are far denser with carbon than the open air.

The Energy Department money, which is a record investment in the sector and the largest from a government, is designed to create an industry that is seen as vital to limiting climate change. Even the most optimistic scenarios of the transition away from fossil fuels don’t forecast sufficient emissions progress without removing some of what is there already and mitigating unavoidable emissions in the future.

“We have to get these projects up and running so there’s a commercial wave that follows them,” said David Crane, the Energy Department’s undersecretary for infrastructure. He previously was chief executive of power-generation company NRG.

If funded and completed, the two carbon-removal hubs would remove roughly 1 million metric tons of carbon dioxide from the atmosphere annually and store it underground. That amount is equivalent to the annual emissions of about 220,000 gasoline-powered cars, which is a fraction of what is needed overall to limit climate change. Each project would be roughly 250 times bigger than the only direct-air capture facility currently in commercial operation.

The Energy Department is also trying to spur a feasible business model for the industry by pledging to pay $35 million for carbon that the companies remove from the air. These are the same type of carbon-credit purchases that Microsoft and JPMorgan Chase have made recently to kick-start the industry. That funding also isn’t limited to direct-air capture, potentially boosting other promising approaches.

Large fossil-fuel companies have long been interested in technologies that remove carbon from the atmosphere because they could neutralize the emissions their products create.

Occidental, the most aggressive fossil-fuel giant in carbon removal, is spending billions of dollars on the effort. Chief Executive Vicki Hollub has said direct-air capture would enable the company to keep producing oil for decades.

The company said recently that it is buying one of its technology partners on the Texas hub, startup Carbon Engineering, for $1.1 billion, the largest such transaction in the industry.

Many climate analysts remain skeptical of carbon removal, worrying that it is too expensive while fearing it could give fossil-fuel producers a social license to continue polluting. Critics argue that removing carbon from the atmosphere just to offset new carbon pumped in by fossil fuels won’t help fight climate change.

“It really does raise some fundamental questions about the political sustainability of these efforts,” said Danny Cullenward, a research fellow at American University’s Institute for Carbon Removal Law and Policy. “People are increasingly assuming that oil production and [direct-air capture] go together. That’s not healthy if your goal is to separate those things.”

Cumulative amount of carbon-dioxide removals completed, monthly.

Source: CDR.fyiNote: Data provider aggregates data from public sources and private sectorDirect-air capture will have a crucial role in helping the world reach its climate goals, Hollub said in a written statement, adding that her company’s selection shows that it has the technology and project expertise to neutralize carbon emissions.

A White House spokeswoman declined to comment.

Exxon Mobil, meanwhile, agreed in July to pay almost $5 billion for Denbury, a pipeline operator that moves carbon dioxide. Denbury’s pipelines typically carry carbon captured in smokestacks rather than the open air, but its infrastructure could be used for both efforts. The company also injects carbon into aging oil fields to boost output using the process known as enhanced oil recovery.

The carbon-removal hubs were funded in the 2021 infrastructure law. The companies have to contribute funds equivalent to the government grants and would be responsible for any cost overruns. The Energy Department will soon award billions of dollars for hydrogen hubs using more infrastructure-law funding, another step to jump-start a critical climate sector.

The key company in the Louisiana carbon-removal hub is Climeworks, which runs the world’s first commercial direct-air capture facility in Iceland. In addition to selling credits to big companies, the company raised $650 million privately from large investors early last year, another financial milestone for the industry.

Businesses are eager to mitigate their own emissions, and popular carbon credits such as forest preservation or renewable energy have been criticized for failing to reduce carbon in the atmosphere.

Carbon removal has become increasingly popular for businesses because it provides certainty that companies are helping the climate, though many consumers remain hesitant.

“There’s no illusion that the taxpayers rose as one and asked for a direct-air capture program,” said the Energy Department’s Crane.

Indian students and families gather to watch the Birla Industrial and Technological Museum (BITM) live telecast of the Chandrayaan-3 Mission landing on the moon in Kolkata, India, on Wednesday. (Piyal Adhikary, EPA-EFE/Shutterstock)Opinion: India’s brilliant moon landing illuminates Russia’s drastic decline

TWP by David Von Drehle, Deputy opinion editor and columnist, August 23, 2023 India’s Chandrayaan-3 lunar lander arrived right on schedule near the moon’s south pole on Wednesday, ready to release a robotic laboratory to explore this little-known real estate. The dark side of the moon, as it is called (especially by fans of Pink Floyd), is home to high hopes for many of those who dream of interplanetary travel. They believe the south polar region might contain abundant water that could be used to make rocket fuel at a future permanent base, allowing the moon to serve as a sort of truck stop en route to Mars.

Others speculate that the frozen, shadowed dark side is rich in minerals needed for high-tech applications on Earth. For them, the Indian rover will be a 21st-century version of the pick-wielding miner of American frontier lore — scratching away in hopes of starting a gold rush.

It’s a marvelous achievement for India’s space program — and symbolic of an important moment in geopolitics. For the successful landing came just days after a Russian mission to the same region went haywire and smashed into the lunar surface like a hammer coming down on the last nail in the coffin of Russia’s decline.

Hyperbole? Not for the nation that made its space program a billboard for its rise to global influence. As the dominant republic of the Soviet Union, Russia was first to put a satellite into orbit, first to send a human into space and first to land a spacecraft on the moon, among other pioneering missions. Luna 9 touched down lightly on the dust of the lunar Oceanus Procellarum (the “Ocean of Storms”) in February 1966, more than three years before the United States finally surpassed the Soviets by landing two men on the moon and bringing them home safely.

But 1966 was a long time ago. It’s the year Hewlett-Packard developed its first computer. It’s the year Fresca and Twister debuted. Frank Sinatra released “Strangers in the Night,” dooby, dooby, doo. Today’s Russia is trying to replicate an achievement from 1966 — and failing. It speaks volumes about the reckless waste of a once-great nation’s capabilities.

Of course, there’s nothing to learn from the lunar crash site that the world hasn’t seen already on the battlefields of Ukraine, where the once-fearsome Russian tank columns were wiped out by Ukrainian volunteers, or in the looting of the Russian economy, which has seen pitiful net growth (in constant dollars) since the collapse of the Soviet Union more than 30 years ago. Here, too, a comparison with India is illuminating: India’s economy was about half the size of Russia’s when the Berlin Wall came down in 1989. Today, India’s economy is 50 percent bigger than Russia’s. Forget about keeping pace with the United States; Russia can’t keep up with India.

The point is important because the modern world was designed with Russia as a major pillar. China’s rise has somewhat mediated the instability created by the pillar’s collapse. But China has its own mismanagement problems that have turned a roaring economy into a sputtering mess. Poorly run countries can be dangerous, as Russia has shown in Ukraine. They latch on to bad ideas and pursue them past the point of failure. When this happens to a major nation, the consequences are felt worldwide.

Russia’s demise as a world power and China’s suddenly clouded future demand new thinking from Winston Churchill’s “indispensable nation,” the United States. Americans and their leaders have been egging each other on for some 20 years in a race to the depths of despair. On both the left and the right, a narrative of national corruption and decline has taken hold. Don’t look to the center for leadership: Everyone there is ducking and covering.

This won’t do, because the world is once again turning to the United States for stability and competence. Russia’s appalling brutalization of Ukraine has driven Europe more firmly toward NATO than ever before. China’s serial missteps have strengthened U.S. alliances throughout the eastern Pacific. Fortunately, the United States has the economic vitality to take on the challenges. Despite sharply higher interest rates to battle unwelcome inflation, the world’s largest economy continues to grow, and is once again nearly 40 percent larger than second place. While other nations attempt to visit the moon, U.S.-led missions have flown a helicopter on Mars, placed a telescope in deep space, probed the weather on Jupiter and sailed beyond the solar system.

Voters should demand — and leaders should deliver — an end to the sniveling and doom-saying that have passed for public discourse in the United States for most of a generation. This can be another American century, in which more people in more places enjoy more freedom and more prosperity than ever before. We just have to be worthy of it. Our rivals are stumbling when they aren’t cutting their own throats; for us, the sky’s the limit.

Just Exceptional...

“Words fail to capture the resplendent magnificence of this exquisite beverage. Its qualities transcend the boundaries of human expression, rendering it a true paragon of its kind. Indeed, it stands unequivocally among the most exceptional —-elixir—- concoctions ever produced…

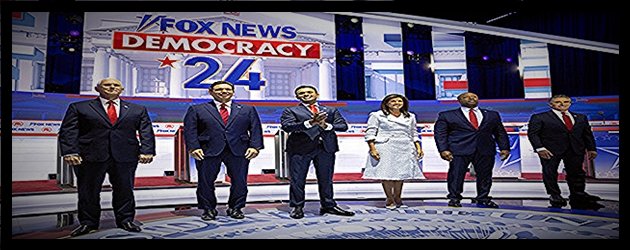

The debate may have reset the race a bit, but only for candidates not named Donald Trump. | Francis Chung/POLITICOWho won, who lost and who fizzled in the first Republican debate

Ron DeSantis was a non-factor as Republicans piled on Vivek Ramaswamy, instead.

By POLITICO STAFF, August 24, 2023Largely ignored for two hours by his lower-polling rivals on Wednesday, the Florida governor watched as the first debate of the GOP primary turned into a pile on Vivek Ramaswamy, the 38-year-old biotech entrepreneur rising in polls.

Mike Pence tangled with Ramaswamy. So did Nikki Haley and Chris Christie. DeSantis, still polling second to former President Donald Trump — but with his campaign floundering — was all but reduced to an afterthought, while Pence, Haley and Christie dominated the stage.

The debate may have reset the race a bit, but only for candidates not named Trump. Who came out the best? Who had a bad night? And did we even learn anything new?

We asked five POLITICO campaign reporters for their takeaways from the first Republican primary debate of 2024.

Who had the best night? Who had the worst night?

Natalie Allison: He took all the hits — seriously, almost all of them — but Vivek Ramaswamy got all he could have wanted out of tonight: attention and the opportunity to reinforce the idea the party’s establishment is out to get him. If you were a Republican who still hadn’t seen a clip of Ramaswamy on social media or TV, you learned who he was tonight. And the fact all knives were out for him shows that the other candidates see him not just as an annoyance, but as a threat right now as they’re trying to break through themselves.

Ron DeSantis’ team, for what it’s worth, was thrilled he wasn’t the one under fire (“didn’t get caught up in the infighting,” is what one of his campaign advisers noted to me afterward), following two months straight of negative headlines, disappointing polling and much more scrutiny and criticism than the rest of the field.

It wasn’t a particularly great night for Tim Scott. He made sure to talk about his childhood, mentioning as often as he could his hardworking single mother to explain how his family pulled themselves up from a difficult place. But none of his answers were that catchy. Recently, Scott has been viewed as someone in the running to overtake DeSantis for the No. 2 spot, but he will need to make more of an impression the next time he’s on stage.

Sally Goldenberg: Mike Pence had the best night. Pence — who has struggled to break out of the pack and was eviscerated by Tucker Carlson in a one-on-one interview this summer — showed more than a little fight with Ramaswamy. He distinguished himself with a clearly articulated foreign policy position on the Russian invasion of Ukraine, courting traditional conservatives. He reminded viewers of his Christian faith, quoting from the Bible and appealing to anti-abortion groups with his support for a federal ban. Finally, he got the support of nearly every opponent on stage for his actions certifying the 2020 election, despite the violent reaction to his decision at the time.

Bottom-tier candidates Asa Hutchinson and Doug Burgum didn’t have the break-through moments they needed — and with the next debate rules setting higher polling thresholds, that may be the last time we see them on stage. Similarly, Tim Scott did not do enough to make a case for himself as the religious conservative in the race.

Steven Shepard: Given the stakes for his sputtering campaign, DeSantis had the best night. He was able to articulate his positions on the issues central to his candidacy. He didn’t face the ire of the others on stage the way Ramaswamy did.

Even when the moderators tried to stoke fights between some of the candidates and DeSantis, they mostly took a pass on punching up at the Florida governor, who was the top-polling candidate on the stage.

Wednesday night didn’t fix all of DeSantis’ problems. But if he does end up back on his feet, it will be a big reason why.

Look, Ramaswamy was the center of attention — and maybe attention is a good thing. But he was at it with a different volume and level of caffeination than everyone else, and the candidates who went after him landed some body blows, whether it was Pence calling him a “rookie” or Haley hitting him on Ukraine.

Adam Wren: Pence had a great night. He seemed to win the exchange over what is supposed to be his biggest weakness: His actions on Jan. 6. Christie, Scott and DeSantis all sided with Pence and his actions on that day. DeSantis tried to sidestep the question, but Pence brought him to heel. “There’s no more important duty,” Pence said. “So answer the question.” He is struggling in the polls, but he projected an adult-in-the-room presence that his campaign has been aiming at for months now.

Mike Pence garnered the support of nearly every opponent on stage for his actions certifying the 2020 election. | Francis Chung/POLITICO

Meanwhile, it seemed like Scott disappeared for stretches throughout the night. And Ramaswamy was clearly a bigger target for the field than DeSantis. That tells you a lot about how the rest of the field assesses the calculus of the race.

Holly Otterbein: All in all, it was a pretty good night for President Joe Biden. Most Republicans on stage raised their hands when asked if they would support Trump in the general election even if he was convicted. Several spoke in favor of a national abortion ban. Those are issues that play in a GOP primary. But they are vulnerabilities next November.

Image: Germán & CoCooperate with objective and ethical thinking…

Seaboard: pioneers in power generation in the country…

…“More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.

An oil rig is seen on Lake Maracaibo, in Cabimas, Venezuela October 14, 2022. REUTERSWashington drafts proposal for Venezuela's oil sanction easing

Reuters by Marianna Parraga, Vivian Sequera and Timothy Gardner, August 24, 2023CARACAS/WASHINGTON, Aug 23 (Reuters) - U.S. officials are drafting a proposal that would ease sanctions on Venezuela's oil sector, allowing more companies and countries to import its crude oil, if the South American nation moves toward a free and fair presidential election, according to five people with knowledge of the plans.

Washington has been trying to encourage negotiations between President Nicolas Maduro and the political opposition over elections in Venezuela and other demands. Sanctions were imposed following Maduro's 2018 reelection, which many Western nations considered a sham.

Easing sanctions has been a carrot held out in the past by the U.S., but which so far has resulted in very few authorizations, including one to Chevron Corp (CVX.N) that has allowed the firm to expand operations in Venezuela and export its oil to the United States since November.

Washington continues to insist that further easing will depend on progress toward elections. U.S. President Joe Biden's government is prepared to provide Venezuela sanctions relief if the country moves to restore democracy, the White House said on Wednesday.

"Should Venezuela take concrete actions toward restoring democracy, leading to free and fair elections, we are prepared to provide corresponding sanctions relief," a spokesperson for the White House's National Security Council said.

A new round of talks began last November in Mexico including Maduro's representatives, the opposition and U.S. officials, but have shown little progress. A White House spokesperson said Venezuela has not yet taken the necessary steps to restore democracy.

The White House declined to comment on the oil sanctions reframing proposal. Venezuela's negotiation leader, Jorge Rodriguez, and the U.S. State Department did not immediately reply to requests for comment.

MORE OIL FOR MORE PEOPLE

The U.S. is this time considering a specific offer to reframe oil sanctions on the country so crude buyers in Europe and other regions also can resume imports of Venezuelan oil in a structured, organized way, the people said.

The proposal could require Biden to amend U.S. executive orders on Venezuela issued by his predecessor Donald Trump in 2019, or issue new ones.

If parties agree to it and to a series of political demands including the presidential election, the new sanction framework would only maintain restrictions to trade Venezuelan oil with countries including China, Iran and Russia, which are under separate U.S. sanctions, they added.

An early version of the proposal was rejected in July by Dinorah Figuera, head of Venezuela's opposition-led National Assembly which controls the country's foreign assets, after discussions with Venezuela's main opposition parties, two of the people said.

The reason for rejecting the draft proposal, which could become one of the powerful U.S. negotiation tools in future meetings with Maduro's envoys, was the lack of concrete steps by Maduro so far toward fair elections in the country, two of the people said.

Figuera's office did not reply to a request for comment.

Rodriguez said in July that Venezuela would not accept international observation for any elections. The government has also banned prominent politicians from participating in an eventual election as opposition candidates.

No-one should expect any immediate talk about rate cuts, even if there is less finger-wagging from Jerome Powell this year CREDIT: Jacquelyn Martin/APAll eyes are now on the Federal Reserve

US economy has remained unexpectedly robust – but markets could be volatile again

The Telegraph, TOM STEVENSON24 August 2023As we head into the bank holiday weekend, the last days of the summer will as usual be dominated by a smallish gathering of very important people in a high-end fly-fishing resort in Wyoming. The annual Jackson Hole economic symposium might look like a talking shop for policy wonks, but it has evolved over the past 45 years into a key market event.

All investors’ eyes will be on this beautiful spot in the Rocky Mountains when Fed chair Jerome Powell stands up to speak at 3pm UK time tomorrow.

This year’s summit is particularly important because it is expected to provide guidance on the key market questions facing investors today. What happens next for US interest rates and when? Is the Fed done with the remarkable monetary tightening cycle that has overshadowed markets for the past couple of years?

And if it is, how long before the US central bank believes it can safely call time on the post-pandemic inflation surge and take its foot off the interest rate brake?

We should know a lot more by the weekend. But if last year is any guide, markets could be volatile as investors dig into the details of Mr Powell’s keynote speech.

A year ago, the S&P 500 hit an air pocket as markets assessed a short but punchy message from the Fed chair. His words took the wind out of the sails of a powerful rally in the middle of 2022’s bear market, setting up the final down leg to October’s low point.

What he said was really just a statement of the blindingly obvious – that getting on top of inflation would require higher for longer interest rates, a slowdown in the economy and rising unemployment. Just as had been the case 40 years earlier when Powell’s predecessor at the Fed, Paul Volcker, won his battle with inflation, victory would not be painless, he said.

US inflation was transitory after all

US CPI index, three month percentage changeVolcker casts a long shadow over Jackson Hole. When the symposium moved to its current home in 1982, it was in large part to ensure that the Fed chair would attend the event. He was a keen fly fisherman when he wasn’t busy clearing up the mess left by former chair Arthur Burns.

It was Burns who allowed prices to spiral out of control in the post-Vietnam inflation crisis of the 1970s. Powell’s task is arguably easier than Volcker’s, but no less important. He knows that his legacy, and the credibility of the central bank he heads, is at stake this week.

Powell’s speech is not the only thing happening at Jackson Hole this week. The summit is an opportunity for policy makers from around the world to get together to discuss the weighty matters of the day, and this year’s focus is on “Structural Shifts in the Global Economy”.

So, there will no doubt be plenty on China, Russia, AI and much else. But what most investors are tuning in for is the subtle hints that Powell’s carefully crafted words will convey. They will be hoping for something more reassuring than last year’s nine-minute cold shower.

What should we expect this year? Things have certainly moved on in 12 months but not exactly as Powell or the markets might have anticipated. The reason the market reacted so badly to Powell’s words a year ago was the not unreasonable assumption that the Fed was prepared to push the US into recession if that is what was required.

But the US economy has proved unexpectedly robust since last August. And investors have had to get used to a different narrative. A year ago, it seemed plausible that the Fed would tighten hard but then pivot rapidly to easier policy as it became clear that it had squeezed too aggressively. Today, with a still hot labour market and a US consumer that refuses to lie down, it remains valid to ask whether the Fed has squeezed hard enough.

Americans earn more

Average wages in G7 countriesThe run up in bond yields this week indicates to me that the market thinks interest rates could rise a bit further yet. With the ten-year yield at 4.3pc and the two-year touching 5pc, investors seem to be pricing in another quarter point hike, perhaps at the November meeting.

And no-one really expects rates to start coming down again until next summer at the earliest in the absence of a more significant slowdown than now looks likely. The relationship between those short and long bond yields – the yield curve – continues to point to a recession, but there’s precious little evidence on the ground.

The trajectory of interest rates this year has been a salutary reminder of the risks of trying to time the market. At the start of 2023, it looked reasonable to expect the Fed to be toying with a first interest rate cut by now. The pivot has been pushed out by at least a year and the peak will be higher than previously thought.

The idea was that government bonds would be a good investment thanks to the double whammy of locking in an attractive yield and then benefiting from a capital gain as rates started to fall again. The thinking looks good, the timing less so.

The minutes from the last Fed meeting gave us a clue to the Fed chair’s current thinking. “We’ll be comfortable cutting rates when we’re comfortable cutting rates, and that won’t be this year I don’t think”, was how he framed it.

So, no-one should expect any immediate talk about rate cuts, even if there is less finger-wagging from Powell this year. He’s done the hard part for any central banker, managing expectations. Time to enjoy the mountains.