News round-up, June 1, 2023

Crossing the line can be dangerous.

In September 2002, I published on Energycentral.com an essay titled: *"Beware of Starving the Enemy of Oxygen." The paper delved into the dangerous tactic of depriving the adversary of oxygen. The praxis entails maintaining an open door to any potential solution that has been identified. The article "Biden Shows Growing Appetite to Cross Putin's Red Lines," published in the Wall Street Journal, offers valuable insights into President Biden's inclination to confront the limitations imposed by the Russian leader, Putin. Despite the suspicions of a potential global conflict, this action is a subject of significant apprehension. The former Secretary of State, Henry Kissinger, has warned that when two powers of similar strength oppose, it often results in armed conflict. The need for clearly defined principles for conflict management is reminiscent of the period preceding the onset of World War I. The unresolved inquiry concerns the feasibility of peaceful coexistence between China and the United States and whether it can be achieved without the potential risk of military conflict. Kissinger proposes the implementation of measures to foster competition in strategic domains, as well as the establishment of an ongoing high-level dialogue between Beijing and Washington. Unfortunately, there has been a significant increase in the frequency of reports concerning drone attacks targeting Russian infrastructure and military installations. The extent of these attacks has exceeded the confines of the front line. It can be categorized as shaping operations, which may serve as a preliminary step towards a counteroffensive by Kyiv. The recent fire incident at the Afipsky refinery has brought attention to the potential outcomes and advantages of pushing against the limits set by President Putin, as there is a possibility that a drone caused the incident.

*https://energycentral.com/c/og/beware-starving-enemy-oxygenMost Read…

Climate Shocks Are Making Parts of America Uninsurable. It Just Got Worse.

The largest insurer in California said it would stop offering new coverage. It’s part of a broader trend of companies pulling back from dangerous areas.

NYT By *Christopher Flavelle, Jill Cowan and Ivan Penn, May 31, 2023

As U.S. Races Ahead, Europe Frets About Battery Factory Subsidies

The European Union is trying to assemble the building blocks to produce electric cars, but subsidies are luring companies to the United States.

NYT By *Jack Ewing and Melissa Eddy, Published May 31, 2023, Updated June 1, 2023Texas battery rush: Oil state's power woes fuel energy storage boom

To increase reliability, Texas lawmakers this week approved increased subsidies for natural gas power facilities. However, the legislation also includes clauses that, according to business associations, could promote investment in battery storage.

REUTERS By Nichola Groom and Laila Kearney, May 31, 2023Biden shows growing appetite to cross Putin’s red lines

Despite warnings that arming Ukraine will start a world war, President Biden continues to push the Russian leader’s limits — a strategy that brings risk and reward

TWP By John Hudson and Dan Lamothe, June 1, 2023

Drones targeted Russian oil refineries. Moscow is strengthening its front line, but the attackers' identity is unknown.

Intelligence reports suggest enemy forces are advancing ahead of a planned Ukrainian counteroffensive.

Media Editing By Germán & Co, June 1, 2023'Henry Kissinger, celebrating his 100th birthday, is as pessimistic as ever'

Le Monde by Alain Frachon, Published today

The AES Corporation President Andrés Gluski, Dominican Republic Minister of Industry and Commerce Victor Bisonó, and Rolando González-Bunster, CEO of InterEnergy Group, spoke at the Latin American Cities Conferences panel on "Facilitating Sustainable Investment in Strategic Sectors" on April 12 in Santo Domingo, Dominican Republic.How can strategic investment achieve both economic growth and social progress?… What is the role of renewable energy and battery storage in achieving the goals of the low-carbon economy?…

Image: Germán & CoCooperate with objective and ethical thinking…

Source: A firefighter tried to save a home in Meyers, Calif., in 2021. Credit...Max Whittaker for The New York Times/Editing by Germán & CoClimate Shocks Are Making Parts of America Uninsurable. It Just Got Worse.

The largest insurer in California said it would stop offering new coverage. It’s part of a broader trend of companies pulling back from dangerous areas.

NYT By *Christopher Flavelle, Jill Cowan and Ivan Penn, May 31, 2023

*Christopher Flavelle, who has long covered the impacts of climate change on the insurance market, reported from Washington. Jill Cowan and Ivan Penn reported from Los Angeles.The climate crisis is becoming a financial crisis.

This month, the largest homeowner insurance company in California, State Farm, announced that it would stop selling coverage to homeowners. That’s not just in wildfire zones, but everywhere in the state.

Insurance companies, tired of losing money, are raising rates, restricting coverage or pulling out of some areas altogether — making it more expensive for people to live in their homes.

“Risk has a price,” said Roy Wright, the former official in charge of insurance at the Federal Emergency Management Agency, and now head of the Insurance Institute for Business and Home Safety, a research group. “We’re just now seeing it.”

In parts of eastern Kentucky ravaged by storms last summer, the price of flood insurance is set to quadruple. In Louisiana, the top insurance official says the market is in crisis, and is offering millions of dollars in subsidies to try to draw insurers to the state.

And in much of Florida, homeowners are increasingly struggling to buy storm coverage. Most big insurers have pulled out of the state already, sending homeowners to smaller private companies that are straining to stay in business — a possible glimpse into California’s future if more big insurers leave.

Growing ‘catastrophe exposure’

State Farm, which insures more homeowners in California than any other company, said it would stop accepting applications for most types of new insurance policies in the state because of “rapidly growing catastrophe exposure.”

The company said that while it recognized the work of California officials to reduce losses from wildfires, it had to stop writing new policies “to improve the company’s financial strength.” A State Farm spokesman did not respond to a request for comment.

Insurance rates in California jumped after wildfires became more devastating than anyone had anticipated. A series of fires that broke out in 2017, many ignited by sparks from failing utility equipment, exploded in size with the effects of climate change. Some homeowners lost their insurance entirely because insurers refused to cover homes in vulnerable areas.

Michael Soller, a spokesman for the California Department of Insurance, said the agency was working to address the underlying factors that have caused disruption in the insurance industry across the country and around the world, including the biggest one: climate change.

He highlighted the department’s Safer From Wildfires initiative, a fire resilience program, and noted that state lawmakers are also working to control development in the areas at highest risk of burning.

But Tom Corringham, a research economist with the Scripps Institution of Oceanography at the University of California San Diego who has studied the costs of natural disasters, said that allowing people to live in homes that are becoming uninsurable, or prohibitively expensive to insure, was unsustainable.

He said that policymakers must seriously consider buying properties that are at greatest risk, or otherwise moving residents out of the most dangerous communities.

“If we let the market sort it out, we have insurers refusing to write new policies in certain areas,” Dr. Corringham said. “We’re not sure how that’s in anyone’s best interest other than insurers.”

A broken model

California’s woes resemble a slow-motion version of what Florida experienced after Hurricane Andrew devastated Miami in 1992. The losses bankrupted some insurers and caused most national carriers to pull out of the state.

In response, Florida established a complicated system: a market based on small insurance companies, backed up by Citizens Property Insurance Corporation, a state-mandated company that would provide windstorm coverage for homeowners who couldn’t find private insurance.

For a while, it mostly worked. Then came Hurricane Irma.

The 2017 hurricane, which made landfall in the Florida Keys as a Category 4 storm before moving up the coast, didn’t cause a particularly great amount of damage. But it was the first in a series of storms, culminating in Hurricane Ian last October, that broke the model insurers had relied on: One bad year of claims, followed by a few quiet years to build back their reserves.

Since Irma, almost every year has been bad.

Private insurers began to struggle to pay their claims; some went out of business. Those that survived increased their rates significantly.

More people have left the private market for Citizens, which recently became the state’s largest insurance provider, according to Michael Peltier, a spokesman. But Citizens won’t cover homes with a replacement cost of more than $700,000, or $1 million in Miami-Dade County and the Florida Keys.

That leaves those homeowners with no choice but private coverage — and in parts of the state, that coverage is getting harder to find, Mr. Peltier said.

‘Just not enough wealth’

Florida, despite its challenges, has an important advantage: A steady influx of residents who remain, for now, willing and able to pay the rising cost of living there. In Louisiana, the rising cost of insurance has become, for some communities, a threat to their existence.

Like Florida after Andrew, Louisiana’s insurance market started to buckle after insurers began leaving following Hurricane Katrina in 2005. Then, starting with Hurricane Laura in 2020, a series of storms pummeled the state. Nine insurance companies failed; people began rushing into the state’s own version of Florida’s Citizens plan.

The state’s insurance market “is in crisis,” Louisiana’s insurance commissioner, James J. Donelon, said in an interview.

In December, Louisiana had to increase premiums for coverage provided by its Citizens plan by 63 percent, to an average of $4,700 a year. In March, it borrowed $500 million from the bond market to pay the claims of homeowners who had been abandoned when their private insurers failed, Mr. Donelon said. The state recently agreed to new subsidies for private insurers, essentially paying them to do business in the state.

Mr. Donelon said he hoped that the subsidies would stabilize the market. But Jesse Keenan, a professor at Tulane University in New Orleans and an expert in climate adaptation and finance, said the state’s insurance market would be hard to turn around. The high cost of insurance has begun to affect home prices, he said.

In the past, it would have been possible for some communities — those where homes are passed down from generation to generation, with no mortgages required and no banks demanding insurance — to go without insurance altogether. But as climate change makes storms more intense, that’s no longer an option.

“There’s just not enough wealth in those low-income communities to continue to rebuild, storm after storm,” Dr. Keenan said.

A shift to risk-based pricing

Even as homeowners in coastal states face rising costs for wind coverage, they’re being squeezed from yet another direction: Flood insurance.

In 1968, Congress created the National Flood Insurance Program, which offered taxpayer-backed coverage to homeowners. As with wildfires in California and hurricanes in Florida, the flood program arose from what economists call a market failure: Private insurers wouldn’t provide coverage for flooding, leaving homeowners with no options.

The program achieved its main goal, of making flood insurance widely available at a price that homeowners could afford. But as storms became more severe, the program faced growing losses.

In 2021, FEMA, which runs the program, began setting rates equal to the actual flood risk facing homeowners — an effort to better communicate the true danger facing different properties, and also to stanch the losses for the government.

Those increases, which are being phased in over years, in some cases amount to enormous jumps in price. The current cost of flood insurance for single-family homes nationwide is $888 a year, according to FEMA. Under the new, risk-based pricing, that average cost would be $1,808.

And by the time current policyholders actually have to pay premiums that reflect that full risk, the impacts of climate change could make them much higher.

“Properties located in high-risk areas should plan and expect to pay for that risk,” David Maurstad, head of the flood insurance program, said in a statement.

The best way for policymakers to help keep insurance affordable is to reduce the risk people face, said Carolyn Kousky, associate vice president for economics and policy at the Environmental Defense Fund. For example, officials could impose tougher building standards in vulnerable areas.Government-mandated programs, like the flood insurance plan, or Citizens in Florida and Louisiana, were meant to be a backstop to the private market. But as climate shocks get worse, she said, “we’re now at the point where that’s starting to crack.”

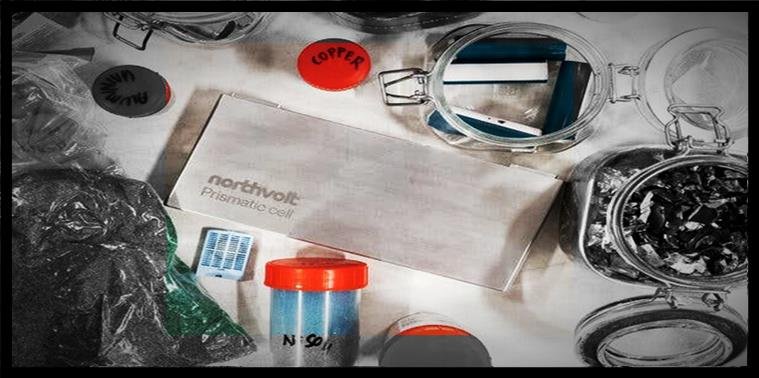

Image: Northvolt is a small player in the global battery industry, but European countries are offering it hundreds of millions of euros to build factories.Credit...Felix Odell/Editing by Germán & CoAs U.S. Races Ahead, Europe Frets About Battery Factory Subsidies

The European Union is trying to assemble the building blocks to produce electric cars, but subsidies are luring companies to the United States.

NYT By *Jack Ewing and Melissa Eddy, Published May 31, 2023, Updated June 1, 2023*Jack Ewing reported from Vasteras, Sweden; Oslo; and Guben, Germany. Melissa Eddy reported from Salzgitter, Germany, and Berlin.European leaders complained for years that the United States was not doing enough to fight climate change. Now that the Biden administration has devoted hundreds of billions of dollars to that cause, many Europeans are complaining that the United States is going about it the wrong way.

That new critique is born of a deep fear in Germany, France, Britain and other European countries that Washington’s approach will hurt the allies it ought to be working with, luring away much of the new investments in electric car and battery factories not already destined for China, South Korea and other Asian countries.

That concern is the main reason some European leaders, including Germany’s second-highest-ranking official, Robert Habeck, have beaten a path to Vasteras, a city about 60 miles from Stockholm that is best known for a Viking burial mound and a Gothic cathedral.

Officials have been traveling there to court one of Europe’s few homegrown battery companies, Northvolt. Led by a former Tesla executive, Northvolt is a small player in the global battery industry, but European leaders are offering it hundreds of millions of euros to build factories in Europe. Mr. Habeck visited in February to lobby the company to push ahead on its plan to build a factory near Hamburg, Germany. The company had considered postponing to invest in the United States instead.

“It’s definitely attractive to be in America right now,” Emma Nehrenheim, Northvolt’s chief environmental officer, said in an interview last month in Vasteras. Northvolt declined to comment in detail on the discussions about the Hamburg plant, which the company committed to in May.

The tussle over Northvolt’s plans is an example of the intense and, some European officials say, counterproductive competition between the United States and Europe as they try to acquire the building blocks of electric vehicle manufacturing to avoid becoming dependent on China, which dominates the battery supply chain.

Auto experts said that the tax credits and other incentives offered by President Biden’s main climate policy, the Inflation Reduction Act, had siphoned some investment from Europe and put pressure on European countries to offer their own incentives.

The United States has provoked a “massive subsidy race,” Cecilia Malmstrom, a former European trade commissioner, said during a panel discussion last month at the Peterson Institute for International Economics in Washington. She called on leaders to “jointly invest in the green transition and not compete against each other.”

Biden officials have argued that U.S. and European policies are complementary. They have noted that the government and private money going into electric cars and batteries would lower prices for car buyers and put more emission-free vehicles on the road.

Efforts by governments to promote electric vehicles “will spur a degree of technological innovation and cost cutting that will be beneficial not only to Europe and the United States, but to the global economy and to our global effort to meet the challenge that climate change presents,” Wally Adeyemo, the deputy Treasury secretary, said in a recent interview.

The Biden administration has also been talking with European officials about allowing cars made from European battery materials and components to qualify for U.S. tax credits. And the administration has interpreted the I.R.A., which Mr. Biden signed in August, to leave room for producers in Europe and elsewhere to benefit.

“You’re seeing less of a concern from Europe that those companies may be lured away from Europe to America,” said Abigail Wulf, who directs the Center for Critical Minerals Strategy at SAFE, a nonprofit organization.

Still, the law has forced European leaders to put new industrial policies in place.

In March, the European Commission, the administrative arm of the European Union, proposed the Critical Raw Materials Act, legislation to ensure supplies of lithium, nickel and other battery materials. One piece of the legislation calls for the E.U. to process at least 40 percent of the raw materials that the car industry needs within its own borders. The 27-nation alliance has also let countries provide more financial support to suppliers and manufacturers.

The money that the United States and Europe are pouring into electric vehicles will encourage sales, said Julia Poliscanova, a senior director at Transport & Environment, an advocacy group in Brussels. The legislation, which will need the approval of the European Parliament and the leaders of E.U. countries, would also bring some coherence to the fragmented policies of national governments, she said.

But Ms. Poliscanova added that European and U.S. policies risk canceling each other out. “Because everyone is scaling up at the same time, it’s a zero-sum game,” she said.

Business executives have complained that applying for financial aid in Europe is bureaucratic and slow. The Inflation Reduction Act, with its emphasis on tax credits, is simpler and faster, said Tom Einar Jensen, chief executive of the battery maker Freyr, which is building a factory in Mo i Rana, in northern Norway, and has plans to construct more plants in Finland and near Atlanta.

The I.R.A. has prompted “a dramatic increase in uptick in interest for batteries produced in the U.S.,” Mr. Jensen said in an interview.

The future of European auto manufacturing is at stake, particularly for German companies. Mercedes-Benz, BMW and Volkswagen have already lost market share in China to local automakers like BYD. Chinese automakers, including BYD and SAIC, are also making inroads in Europe. Selling cars under the British brand MG, SAIC has amassed 5 percent of the European electric vehicle market, putting it ahead of Toyota and Ford in that fast-growing segment.

European carmakers are frantically trying to build the supply chains they need to churn out electric vehicles.

In France, President Emmanuel Macron wants to convert a northern region where factory jobs have been in decline into a hub of battery production.

On Tuesday, Automotive Cells Company, a joint venture between Stellantis, Mercedes-Benz and TotalEnergies, inaugurated a factory in Billy-Berclau Douvrin, France, that aims to produce 300,000 electric batteries annually by the end of 2024. A.C.C. also plans to invest a total of 7.3 billion euros, or $7.8 billion, in Europe, including opening factories in Germany and in Italy, a deal sealed with 1.3 billion euros in public aid.

In Salzgitter, Germany, some 25 miles from Volkswagen’s headquarters, steel beams tower above concrete foundations as excavators and dump trucks hum nearby. In a matter of months, the outlines of a battery factory have risen out of a field.

Volkswagen hopes to have battery-making machines installed before the end of the summer. By 2025, the automaker aims to produce battery cells for up to 500,000 electric vehicles a year — a timeline that the company said was possible only because the factory was being built on land it owned.

Volkswagen is also building a factory in Ontario, but the company made the decision to do so only after the Canadian government matched U.S. incentives.

In Guben, a small city on Germany’s border with Poland, Rock Tech Lithium, a Canadian company, is building a plant to process lithium ore. Mercedes has an agreement with Rock Tech to supply lithium to its battery producers.

These projects won’t reach full production for several years. Recently, the Guben site was an open field. The only construction activity was a truck that dumped loads of crushed rock, making an ear-piercing screech.

Europe has some advantages, including a strong demand for electric cars: About 14 percent of new cars sold in the E.U. in the first three months of this year were battery powered, according to Schmidt Automotive Research, twice as many as in the United States.

But if Europe doesn’t move quickly to aid the battery industry, “you will really lose momentum on the ground versus the North American market,” said Dirk Harbecke, chief executive of Rock Tech.

Chinese battery companies have largely avoided the United States for fear of a political backlash. But Chinese battery firms have announced investments in Europe worth $17.5 billion since 2018, according to the Mercator Institute for China Studies and the Rhodium Group.

Political tension between Western governments and China has put German carmakers in a delicate position. They do not want to be overly dependent on Chinese supplies, but they cannot afford to displease the Chinese government.

BMW, Volkswagen and Volvo plan to buy cells from a factory in Arnstadt, Germany, run by CATL, a Chinese company that is currently the world’s largest maker of electric vehicle batteries.

To balance their reliance on Chinese suppliers, European executives and leaders are keen to work with Northvolt, whose chief executive, Peter Carlsson, oversaw Tesla’s supply chain for more than four years.

Northvolt wants to control all the steps of making batteries, including refining lithium and recycling old cells. That should help Europe achieve supply chain independence and ensure that batteries are produced in the most environmentally responsible way possible, said Ms. Nehrenheim, who is also a member of the Northvolt management board. “We’re de-risking Europe,” she said.

The company develops manufacturing techniques at its complex in Vasteras. Northvolt’s first full-scale factory, at a site in Sweden 125 miles south of the Arctic Circle chosen for its abundant hydropower, is the size of the Pentagon. Northvolt also plans to build a U.S. factory, but has not yet announced a site.

Still, the company is ramping up production and is not among the world’s top 10 battery suppliers, according to SNE Research, a consulting firm. And construction on its Hamburg plant is on hold until E.U. officials approve German subsidies.

An engineer checks an inverter next to battery banks at GlidePath's Byrd Ranch energy storage facility in Sweeny, Texas, U.S., May 23, 2023. REUTERS/Adrees LatifTexas battery rush: Oil state's power woes fuel energy storage boom

To increase reliability, Texas lawmakers this week approved increased subsidies for natural gas power facilities. However, the legislation also includes clauses that, according to business associations, could promote investment in battery storage.

REUTERS By Nichola Groom and Laila Kearney, May 31, 2023May 31 (Reuters) - BlackRock, Korea's SK, Switzerland's UBS and other companies are chasing an investment boom in battery storage plants in Texas, lured by the prospect of earning double-digit returns from the power grid problems plaguing the state, according to project owners, developers and suppliers.

Projects coming online are generating returns of around 20%, compared with single digit returns for solar and wind projects, according to Rhett Bennett, CEO of Black Mountain Energy Storage, one of the top developers in the state.

"Resolving grid issues with utility-scale energy storage is probably the hottest thing out there,” he said.

The rapid expansion of battery storage could help prevent a repeat of the February 2021 ice storm and grid collapse which killed 246 people and left millions of Texans without power for days.

The battery rush also puts the Republican-controlled state at the forefront of President Joe Biden's push to expand renewable energy use.

Reuters drew on previously unreported data and interviewed more than a dozen executives from private equity firms, utility companies and energy storage providers involved in some of the biggest battery storage deals for this report. They described a rush to take advantage of the high returns before they erode.

Power prices in Texas can swing from highs of about $90 per megawatt hour (MWh) on a normal summer day to nearly $3,000 per MWh when demand surges on a day with less wind power, according to a simulation by the federal government's U.S. Energy Information Administration.

That volatility, a product of demand and higher reliance on intermittent wind and solar energy, has fueled a rush to install battery plants that store electricity when it is cheap and abundant and sell when supplies tighten and prices soar.

Texas last year accounted for 31% of new U.S. grid-scale energy storage, according to energy research firm Wood Mackenzie, second only to California which has had a state mandate for battery development for a decade.

While declining, Texas’s share of U.S. grid-scale energy storage capacity will stay the second largest in the country, next only to California where battery development has been state-supported for years.

LEADER IN ENERGY STORAGE

And Texas is expected to account for nearly a quarter of the U.S. grid-scale storage market over the next five years, according to Wood Mackenzie projections shared with Reuters.

Developers and energy traders said locations offering the highest returns -- in strapped areas of the grid -- will become increasingly scarce as more storage comes online and electricity prices stabilize.

Texas lawmakers this week voted to provide new subsidies for natural gas power plants in a bid to shore up reliability. But the legislation also contains provisions that industry groups said could encourage investment in battery storage.

Amid the battery rush, BlackRock acquired developer Jupiter Power from private equity firm EnCap Investments late last year. Korea's SK E&S acquired Key Capture Energy from Vision Ridge Partners in 2021 and UBS bought five Texas projects from Black Mountain last year for a combined 700 megawatts (MW) of energy storage. None of the sales' prices were disclosed.

SK E&S said its acquisition of Key Capture was part of a strategy to invest in U.S. grid resiliency.

"SK E&S views energy storage solutions in Texas and across the U.S. as a core technology that supports a new energy infrastructure system to ensure American homes and businesses have affordable power," the company said in a statement.

UBS and BlackRock declined to comment.

Installed generating capacity in energy storage is forecast by the government to rise over 10 times by 2050 from 2023 as potential investors benefit from new tax credit for the sector under the Inflation Reduction Act of 2022.

U.S. energy storage companies attracted $5.5 billion in investment last year, according to Mercom Capital Group. The U.S. is projected to install 65 gigawatts (GW) of grid storage over the next five years, 15 times the 4 GW added last year, according to Wood Mackenzie, buoyed by a 30% tax credit for energy storage in Biden's Inflation Reduction Act (IRA).

The Electric Reliability Council of Texas (ERCOT), which operates the grid that serves most of the state, has 3.2 GW of energy storage capacity, according to its own data.

The authority said in a statement that more storage was in development. It has pending requests to connect to the grid from plants offering more than 96 GW in storage, according to ERCOT data. ERCOT declined an interview request.

'CLOAK AND DAGGER'

"It's cheaper to build there, the revenue is higher, and the problems are real," said Andrew Waranch, president of Spearmint Energy, which acquired about 1 GW of Texas projects in the last year.

While some investors have focused on specific locations with maximum volatility, more than 80% of the revenue comes from the Ancillary Services Market, which seeks to stabilize power supply across the grid, according to David Miller, vice president of business development at Gridmatic, which uses artificial intelligence to optimize battery use.

Miller said he expects ancillary market prices to "collapse" as more battery storage comes online.

Average energy storage revenue already fell about 18% last year, according to a Gridmatic analysis.

Waranch said battery storage plants coming online in 2025 could take up to eight years to break even compared with four or less for plants that come online in 2023.

The urgency has helped fuel a rush to install projects that can get faster regulatory clearance.

Stem Inc (STEM.N) and other developers said they are focusing on small projects of under 10 MW because they face fewer regulatory requirements.

The diminishing returns have also intensified competition for sites in areas with the wildest wholesale power price fluctuations, industry executives said.

"We want to get maximum volatility," said American Enerpower Chairman Dick Lewis, who scours Texas for plots of land near constrained parts of the grid to develop battery plants. "Placement is very important."

So is timing, said Andrew Tang, vice president of energy storage and optimization at Finland's Wartsila, which has supplied about a third of the Texas battery market.

"There's a little bit of cloak and dagger secrecy," he said. "If they think they've seen a trading opportunity that exists in the marketplace, they don't want to openly brag about it because someone else will jump in and therefore get rid of the arbitrage opportunity," he said.

Chris McKissack, CEO of storage developer GlidePath, said that batteries will likely remain a good bet for a long time -- even if Texas is seeking to bolster traditional forms of energy like natural gas.

"If no new generation is built and all you've got is old generation and load growth, you've got even more volatility," McKissack said. And that, he said, could lead to more opportunity for storage.

Seaboard: pioneers in power generation in the country…

…“More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.

Image: Germán & CoBiden shows growing appetite to cross Putin’s red lines

Despite warnings that arming Ukraine will start a world war, President Biden continues to push the Russian leader’s limits — a strategy that brings risk and reward

TWP By John Hudson and Dan Lamothe, June 1, 2023

President Biden and Ukrainian President Volodymyr Zelensky in Kyiv, Ukraine, in February. (Evan Vucci/AP)

President Biden’s decision last month to help Ukraine obtain F-16 fighter jets marked another crossing of a Russian red line that Vladimir Putin has said would transform the war and draw Washington and Moscow into direct conflict.

Despite the Russian leader’s apocalyptic warnings, the United States has gradually agreed to expand Ukraine’s arsenal with Javelin and Stinger missiles, HIMARS rocket launchers, advanced missile defense systems, drones, helicopters, M1 Abrams tanks and, soon, fourth-generation fighter jets.

A key reason for brushing aside Putin’s threats, U.S. officials say, is a dynamic that has held since the opening days of the war: Russia’s president has not followed through on promises to punish the West for providing weapons to Ukraine. His bluffing has given U.S. and European leaders some confidence they can continue doing so without severe consequences — but to what extent remains one of the conflict’s most dangerous uncertainties.

President Biden announced a new $375 million military assistance package for Ukraine during a meeting with Ukrainian President Volodymyr Zelensky on May 21. (Video: Reuters)

“Russia has devalued its red lines so many times by saying certain things would be unacceptable and then doing nothing when they happen,” said Maxim Samorukov, a Russia expert at the Carnegie Endowment for International Peace. “The problem is that we don’t know the actual red line. It’s in one person’s head, and it can change from one day to the next.”

U.S. officials say managing the risk of escalation remains one of the most difficult aspects of the war for Biden and his foreign policy advisers. When deciding what new weapons systems to provide Ukraine, they focus on four key factors, officials said.

“Do they need it? Can they use it? Do we have it? What is the Russian response going to be?” said a senior State Department official. Like others interviewed for this report, this person spoke on the condition of anonymity to discuss sensitive internal deliberations.

The official said Russia’s reluctance to retaliate has influenced the risk calculus of Secretary of State Antony Blinken, a key Biden confidante who has been an influential voice encouraging the administration and U.S. allies to do more to support Ukraine.

“You factor that in your decision-making. We did this — there was no escalation or response — can we do the next thing? We’re constantly weighing those factors and it becomes the hardest judgment call we have to make,” said the official.

Like Blinken, White House national security adviser Jake Sullivan also has viewed the benefits of supplying more lethal weaponry to Ukraine as outweighing the risks of escalation and has worked extensively with European allies on providing F-16s to Ukraine, said a White House official.

The administration has juggled these concerns amid a clamor from Ukrainians and hawks in Congress frustrated by the incremental approach and eager for Biden to move faster in sending more advanced equipment to the battlefield amid Russia’s brutal onslaught.

Russian President Vladimir Putin attends a meeting at the Kremlin in Moscow last week. (Mikhail Klimentyev/AP)

At the outset of Russia’s invasion in February last year, Putin warned that any country that tried to “impede” his forces “must know that the Russian response will be immediate and lead to consequences you have never seen in history.”

As the war has dragged on, the warnings from Putin and his subordinates have only become more bombastic, threatening a nuclear holocaust if Russia faced setbacks on the battlefield.

“If Russia feels its territorial integrity is threatened, we will use all defense methods at our disposal, and this is not a bluff,” Putin said last September.

Dmitry Medvedev, who serves as deputy chairman of Putin’s powerful security council, was more explicit in January. “The defeat of a nuclear power in a conventional war may trigger a nuclear war,” he said.

While Putin has challenged the United States — suspending participation in a critical arms control treaty, imprisoning Wall Street Journal reporter Evan Gershkovich and overseeing a court’s decision to sentence WNBA star Brittney Griner to a nine-year prison term before insisting on a one-for-one trade for a notorious arms merchant — he has not lashed out militarily at Washington or its allies.

But Western officials are cognizant that that doesn’t mean he never will — particularly as the conflict escalates.

On Tuesday, drones struck affluent districts of Moscow in what one Russian politician called the worst attack on the capital since World War II. Ukraine has denied involvement in such strikes within the Russian mainland, and the Biden administration said it neither enables nor encourages Ukrainian attack inside Russia. But Kyiv appears content with Russian civilians experiencing the fears Ukrainians have lived with for more than a year as their population centers have come under relentless Russian missile and drone attacks.

A possible explanation for Putin’s reluctance to hit the West is the diminished state of Russia’s military, according to U.S. officials.

“It would not seem to be in their interest to get into a direct confrontation with NATO right now,” said the senior U.S. official. “They are not well positioned to do so.”

Gen. Mark A. Milley, chairman of the Joint Chiefs of Staff, estimated in a recent interview with Foreign Affairs that Russia has suffered as many as 250,000 dead and wounded since its full-scale invasion began — staggering losses for any conflict.

Putin has replaced them on the battlefield, Milley said, but with reservists who are “poorly led, not well trained, poorly equipped, not well sustained.”

As Russian fatalities have mounted, Putin has recalibrated his war aims, from seizing control of Kyiv and decapitating the government of Ukrainian President Volodymyr Zelensky to controlling and annexing a swath of territory across eastern and southern Ukraine.

Still, U.S. officials remain wary that Russia, home to the world’s largest nuclear arsenal, could escalate in Ukraine or elsewhere. Last year, amid heightened concerns that Russia was considering deploying a nuclear weapon, senior State Department officials privately warned Moscow about the consequences of doing so — messages that were eventually followed by public warnings.

As the Biden administration has weighed such risks, Ukrainian leaders, including Zelensky, have expressed their consternation publicly. The perceived dithering and delay, they’ve claimed, has prolonged the bloodshed by inhibiting Ukraine’s ability to overwhelm the Russian military and force an end to the war.

Republican hawks in Congress, meanwhile, have said the threat of Russian escalation shouldn’t even be a consideration. Rep. Michael McCaul of Texas, chairman of the House Foreign Relations Committee, has called the administration “cowardly” for not sending long-range missile systems known as ATACMS. The weapons have been high on Ukraine’s wish list for almost the entirety of the war.

“Every time the administration has delayed sending Ukraine a critical weapon system, from Stingers to HIMARS to Bradleys, over fears of Russian escalation, they have been proven completely and utterly wrong,” he said earlier this year.

Britain approved the transfer of similar weapons, long-range missiles known as Storm Shadows, in early May.

Ground crews approach a Danish F-16 fighter jet near Vojens, Denmark, on May 25. Denmark is in the process of replacing its F-16 fleet with more advanced F-35s and has committed to training Ukrainian pilots to fly the F-16s. (Bo Amstrup/AFP/Getty Images)

Inside the Biden administration, the Pentagon is considered more cautious than the White House or State Department about sending more sophisticated weaponry to Ukraine, but officials there deny that fear of escalation plays any role in their calculations.

The Defense Department has focused on what Ukraine needs at any given moment, said a senior Pentagon official who defended its role and counsel as Kyiv’s ambitious requests throughout the war have been slow-rolled or turned down. The official cited how the United States has evolved from providing anti-armor missiles such as the Javelin, when it was clear columns of Russian military vehicles would invade, to sending artillery as the war shifted into a bloody duel waged from trenches — and to more recent Western commitments of tanks and F-16 fighter jets.

Before almost any Western arms or equipment can be transferred to the units who will use them, Ukrainian forces first must learn how to operate and maintain what they receive, this person said, praising “how amazing” they’ve been at “standing up what is now a very sophisticated maintenance and sustainment system that did not exist at the beginning of the war.”

In one example, Ukrainian officials for months last year requested the billion-dollar Patriot air defense missile system. U.S. officials held, citing concerns about training, maintenance and cost, but ultimately relented in December after repeated Russian missile barrages targeted Ukrainian civilian infrastructure. One such system donated by the West was damaged after a Russian strike in mid-May, requiring U.S. assistance to repair.

The senior defense official disputed any suggestion that other U.S. agencies are looking to do more to help Ukraine than the Pentagon is. “I think the folks in the Defense Department have a unique understanding of what is practically possible, and how to best support the Ukrainian armed forces in a way that supports them at any given moment on the battlefield,” the official said.

Unquestionably, the Biden administration’s willingness to cross Putin’s red lines has bolstered Ukraine’s ability to defend itself and recapture territory in the east and south. What remains to see, however, is whether Putin will continue to allow the West to defy his threats without consequence.

“Certain red lines exist,” said Alexander Gabuev, director of the Carnegie Russia Eurasia Center in Berlin, “ … but because we don’t have a way to know for sure what they are, that’s what creates risk.”

Ukrainian troops preparing for battle/Editing by Germán & CoDrones targeted Russian oil refineries. Moscow is strengthening its front line, but the attackers' identity is unknown.

Intelligence reports suggest enemy forces are advancing ahead of a planned Ukrainian counteroffensive.

Media Editing By Germán & Co, June 1, 2023According to reports, the Ilyinsky oil refinery in Russia's Krasnodar region was minimally impacted by a possible drone attack. A fire incident occurred at the Afipsky refinery, spreading flames over an area of 1,000 square feet. The regional governor, Veniamin Kondratyev, posits that a drone may have caused the fire, although there were no reported injuries. Regrettably, there has been an increase in drone strikes targeting Russian infrastructure and military installations, which have expanded beyond the confines of the front line. The Russian government has attributed responsibility to Ukraine for these occurrences, and military analysts propose that they may be a component of shaping operations in anticipation of a possible counteroffensive by the forces of Kyiv.

The rise in drone attacks on Russian infrastructure and military targets beyond the front line is worrying. Moscow blames Ukraine, but Kyiv has denied direct involvement in such operations. Military analysts describe the attacks as shaping the stage for a wider counteroffensive by Kyiv's forces. The M1 Abrams tank is a powerful weapon for the U.S., but its complex technology and turbine engine may pose logistical challenges for Ukraine. Drones have been targeting residential buildings in Moscow, including one near a residence of President Vladimir Putin where several were downed. Ukrainian officials denied involvement but expect more strikes. Putin praised Moscow's air defenses but suggested improvements are needed.

Russia is losing the initiative in the Ukraine conflict, say, Western officials. Moscow is reacting to Ukrainian offensives that are setting the battlefield agenda. Russia is reinforcing its defences in Ukraine's east and south. Kyiv claims to be ready for an offensive. The operation will involve multiple brigades with Western-trained soldiers and modern equipment from Ukraine's allies.

Western officials say the nightly drone-and-missile attacks against Ukrainian cities to weaken its air defences and defence capacity has failed. The U.S. has pledged $300 million in military aid to Ukraine, including Patriot munitions, air defence equipment, artillery and tank shells, and mine-clearing systems.

The U.S. has provided $18.7 billion in military equipment from existing stocks and ordered $6 billion in new supplies for Kyiv. The U.S. has given Ukraine over $37.6 billion in security assistance since Russia's invasion. Defense Secretary Lloyd Austin welcomes any support from Japan for Ukraine. Japanese policies prohibit providing lethal weapons to nations at war, so Japan has only given nonlethal aid to Ukraine, such as food rations, helmets, and bulletproof vests.

Western officials claim Russia is using its military to strengthen border areas in response to recent drone attacks and a Ukrainian-backed incursion in Belgorod, Bryansk, and other regions.

'Henry Kissinger, celebrating his 100th birthday, is as pessimistic as ever'

Le Monde by Alain Frachon, Published today Born on May 27, 1923, the former US secretary of state (1973-1977) and realpolitik advocate is concerned with the spiraling conflict between China and the United States, writes columnist Alain Frachon.

Negotiations on Ukraine should be concluded by the end of the year. But the Chinese-American rivalry may in turn lead to war. With artificial intelligence, the battlefield will be more deadly than ever. We are living in an era similar to that which preceded World War I (1914-1918). These are times without defined rules between the great powers. It is an era in search of strategic norms.

Henry Kissinger is speaking from experience. He turned 100 on May 27. He walks with difficulty, has lost vision in one eye and says he gets tired faster. His voice is less confident, but still deep, with hints of his native Germany. He has been following world affairs since the early 1940s. He is as pessimistic as ever, even more so perhaps than when he was steering American diplomacy from 1968 to 1977. He first served as the head of the National Security Council, at the White House, then as US secretary of State.

Kissinger thinks Xi Jinping would "take a phone call from him" and Vladimir Putin would as well. The Chinese president would do it out of deference to his elders, and his Russian counterpart would do it out of respect for a believer in realpolitik. And Kissinger has things to say. He confided in the journalist Ted Koppel, in a lengthy interview on CBS, and in an eight-hour conversation with the weekly The Economist. This was in April, just before celebrating his 100th birthday.

How will the war in Europe end? Most likely, the Ukrainian army will take back a further portion of the land occupied by the Russians since February 24, 2022. On the other hand, the Russians are unlikely to be driven out of Crimea. "The risk is that both Russia and Ukraine will be dissatisfied," said Kissinger. "It will be a balance of frustration." To find a way out of it, the West needs to use its "imagination" and decide on two things at the same time.

Willingly assertive

The first thing to do is to integrate Ukraine into NATO right away: "If I were speaking to him, I'd tell Putin that it's in his own best interest." Membership of the North Atlantic Treaty Organization will ensure Kyiv's protection, but it will also give a sense of responsibility to an over-armed Ukraine that still lacks strategic experience. The second move will be for the Europeans to imagine a rapprochement with Russia, in order to "stabilize the eastern border" of the Union. "Realistic," really, Dr. Kissinger? With Putin's Russia?

Born in 1923 into a Jewish family from the Bavarian bourgeoisie, Henry Kissinger came to the United States in 1938 with his parents. Thirteen of his relatives and cousins perished in the Holocaust. He has been a Harvard professor, a diplomat, an adviser to the great and always on their side, and an admirable writer and chronicler of his times. He grew up with the memory of his family's tragedy.

He saw the collapse of the Weimar Republic and was aware of the fragility of democracy. He distrusts the idealism of the well-meaning and believes in the balance of power. He implemented normalization with Mao's China and, in 1973, negotiated on the fly between Arabs and Israelis while hostilities were still ongoing.

Willingly assertive when confronted by Ted Koppel, he defended the American bombings of Cambodia and Laos in the name of US "credibility" in the negotiations then underway with Vietnam. In the same way, he justified the United States' association with some of the worst dictatorships of the time as being necessary due to the Cold War. His teacher and friend Hans Morgenthau (1904-1980) had warned him: "The very act of acting destroys our moral integrity." And to what do we owe the enthusiastic imprimatur given to the 2003 invasion of Iraq?

Always borne with humor, Kissinger's brand of pessimism is not running short of fuel, now more than ever. It draws from the degeneration of the American domestic political scene. But his deepest concern is the spiraling conflict that is consuming China and the United States. The United States is convinced that China, having benefited from the international order enacted by the Americans in 1945, now wants to replace it with Chinese-style rules. And China, for its part, is convinced that the Americans intend to prevent it from achieving the dominance justified by its political and economic weight.

The doctor's prescription

"When two powers of this type come face to face," said Kissinger, "it normally ends in armed conflict." The two countries no longer have a guiding principle for managing their conflicts. "We are in the very same type of situation as before WWI."

"Is it possible for China and the United States," asks Kissinger, "to coexist without the permanent threat of war between them?" The answer: "Yes, but success is not guaranteed, and, therefore, we must be militarily strong enough to cope." The doctor's orders? Here again, it is a two-pronged action: support competition with China in all areas that matter strategically, and institutionalize permanent high-level dialog between Beijing and Washington.

The test will be in Taiwan, of course. The mistake the United States must avoid is imagining that a change of regime in Beijing would automatically have a beneficial and stabilizing effect. It would be quite the opposite. The danger that threatens China's leaders is believing that history has a meaning, that the time of decline has come for the United States and, for China, it is the time of leadership. May it be said in Beijing, for so says the venerable centenarian.