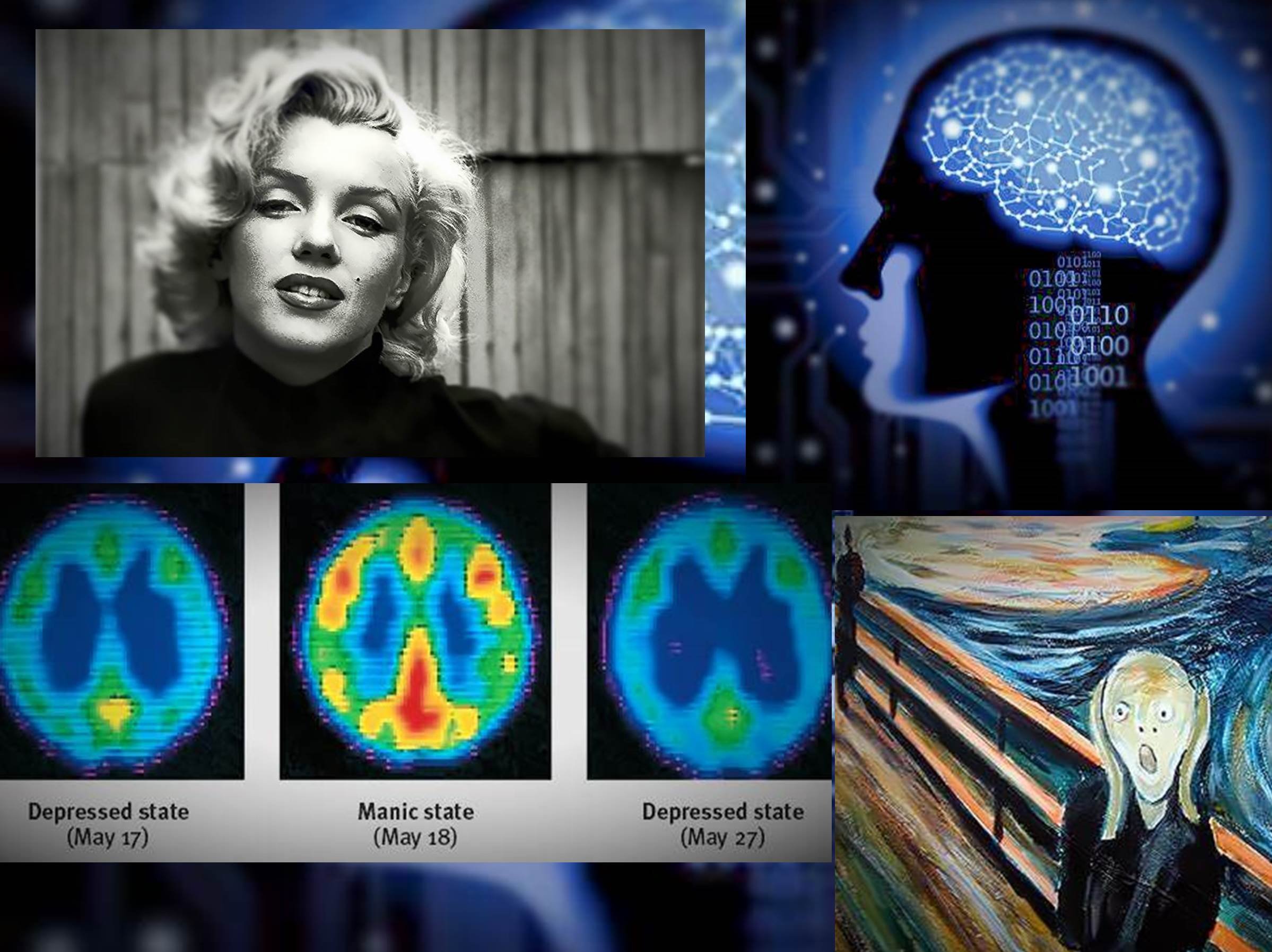

News round-up, March 16, 2023

Quote of the day…

"The next important step needs to come out from their CEO and display their new strategy to the public sooner than later to reassure the markets," Tareck Horchani, head of prime brokerage dealing at Maybank Securities in Singapore.

"There is still the possibility they recover but the road will be very bumpy.”

REUTERSMost read…

Credit Suisse secures $54 bln lifeline as authorities rush to avert global bank crisis

Due to the 167-year-old bank's issues, investors and regulators have shifted their attention from the United States to Europe. Credit Suisse spearheaded a selloff of bank shares after the bank's largest shareholder stated that it was unable to provide additional financial support due to regulatory restrictions.

REUTERS By Tom WestbrookFor Goldman Sachs, SVB's botched stock sale had a silver lining

Goldman carried out only the first portion of that strategy. The illustrious investment bank needed more time after the bond portfolio purchase to persuade investors to lock in capital and dispel worries about depositors withdrawing money from SVB.

REUTER By Echo Wang, Lananh Nguyen and David FrenchWhat does SVB’s collapse mean for other banks? Here’s what else might go wrong — and what to expect next.

Our finance and economics reporters teamed up with a banking regulation expert to answer reader questions on Reddit.

BY POLITICO STAFF, 03/15/2023 Oil regains a bit of ground as Credit Suisse handed a lifeline

"As the U.S. banking crisis spread to Europe, market mood declined. Even though fundamentals may not necessarily be pointing in a bearish direction, the future movement will be determined by the level of market anxiety "In a client note, analysts from Haitong Futures stated.

Reuters by Laura Sanicola and Muyu Xu, editing Germán & CoNord Stream owners discuss pipeline repairs, says E.ON

The operating company's main focus is the subject of how the two damaged pipelines can be first drained and sealed so that the strands do not further corrode.

Reuters, editing by Germán & Co“We’re living in a volatile world…

it’s easy to get distracted by things like changeable commodity prices or a shortage of solar panels. But this wouldn’t be true to our purpose – we can’t allow ourselves to lose sight of our end goal; said Andres Gluski, CEO of energy and utility AES Corp

Credit Suisse secures $54 bln lifeline as authorities rush to avert global bank crisis

Due to the 167-year-old bank's issues, investors and regulators have shifted their attention from the United States to Europe. Credit Suisse spearheaded a selloff of bank shares after the bank's largest shareholder stated that it was unable to provide additional financial support due to regulatory restrictions.

REUTERS By Tom WestbrookMarch 16 (Reuters) - Credit Suisse (CSGN.S) on Thursday said it would borrow up to $54 billion from the Swiss central bank to shore up liquidity and investor confidence after a slump in its shares intensified fears about a global banking crisis.

The Zurich-based bank's announcement helped reverse some of the heavy share market losses and restored confidence in wider financial markets, which were battered on Wednesday and into Asia trade on Thursday as investors fretted about potential runs on global bank deposits.

In its statement, Credit Suisse said it would exercise an option to borrow from the central bank up to 50 billion Swiss francs ($54 billion). That followed assurances from Swiss authorities on Wednesday that Credit Suisse met "the capital and liquidity requirements imposed on systemically important banks" and that it could access central bank liquidity if needed.

Credit Suisse is the first major global bank to be given an emergency lifeline since the 2008 financial crisis and its problems have raised serious doubts over whether central banks will be able to sustain their fight against inflation with aggressive interest rate hikes.

The bank's shares surged 21% in pre-open trade in early European hours. Throughout most of the Asian day, stocks wallowed in the red as investors rushed to gold, bonds and the dollar. While Credit Suisse's announcement helped trim some early losses, trade was volatile and sentiment fragile.

"It removes an immediate risk. But it confronts us with another choice. The more we do this, the more we blunt monetary policy, the more we have to live with higher inflation -- and what is it going to be?" said Damien Boey, chief equity strategist at Barrenjoey in Sydney.

"Do bailouts make things better? On the one hand, you are removing a source of risk to the markets which is a clear and present danger. On the other hand we are feeding into this paradigm of monetary policy bucking within itself."

Credit Suisse's borrowing will be made under the covered loan facility and a short-term liquidity facility, fully collateralised by high quality assets. It also announced offers for senior debt securities for cash of up to 3 billion francs.

"This additional liquidity would support Credit Suisse’s core businesses and clients as Credit Suisse takes the necessary steps to create a simpler and more focused bank built around client needs," the bank said.

Credit Suisse Chief Executive Ulrich Koerner had earlier on Wednesday sought to reassure investors about the lender's strong liquidity.

"Our capital, our liquidity basis is very, very strong," Koerner told media. "We fulfil and overshoot basically all regulatory requirements."

Meanwhile, Credit Suisse bankers in Asia reached out to clients to reassure them after the latest inflow of funds.

"We've been telling them to read the statements and look at the fact that we are buying 3 billion francs worth of bonds because they are so cheap," said a Hong Kong-based senior banker. "That's all we can say and try and plough on with work."

The banker declined to be named as they were not authorised to speak to the media.

EUROPEAN EPICENTRE

The 167-year-old bank's problems have shifted the focus for investors and regulators from the United States to Europe, where Credit Suisse led a selloff in bank shares after its largest investor said it could not provide more financial assistance because of regulatory constraints.

The concerns about Credit Suisse added to broader banking sector fears sparked by last week's collapse of Silicon Valley Bank (SVB) (SIVB.O) and Signature Bank, two U.S. mid-size firms.

Investor focus is also on any action by central banks and other regulators elsewhere to restore confidence in the banking system.

Policymakers in Australia and South Korea sought to reassure markets on Thursday that banks in their jurisdictions were well-capitalised.

SVB's demise last week, followed by that of Signature Bank two days later, sent global bank stocks on a roller-coaster ride as investors feared another Lehman Brothers moment, the Wall Street giant whose failure had triggered the global financial crisis more than a decade ago.

On Wednesday, Credit Suisse shares led a 7% fall in the European banking index (.SX7P), while five-year credit default swaps for the flagship Swiss bank hit a new record high.

The investor exit for the doors raised fears of a broader threat to the financial system, and two supervisory sources told Reuters that the European Central Bank had contacted banks on its watch to quiz them about their exposures to Credit Suisse.

The U.S. Treasury also said it is monitoring the situation around Credit Suisse and is in touch with global counterparts, a Treasury spokesperson said.

NEXT STEPS

Rapid rises in interest rates have made it harder for some businesses to pay back or service loans, increasing the chances of losses for lenders who are also worried about a recession.

Traders are now betting that the Federal Reserve, which just last week was expected to accelerate its interest-rate-hike campaign in the face of persistent inflation, may be forced to hit pause and even reverse course.

Bets on a large European Central Bank interest-rate hike at Thursday's meeting also evaporated quickly on growing fears about the health of Europe's banking sector. Money market pricing suggested traders now saw less than a 20% chance of a 50 basis point rate hike at the ECB meeting.

For now, investors are focussed on what will happen at Credit Suisse next.

"The next important step needs to come out from their CEO and display their new strategy to the public sooner than later to reassure the markets," Tareck Horchani, head of prime brokerage dealing at Maybank Securities in Singapore.

"There is still the possibility they recover but the road will be very bumpy."

The logo for Goldman Sachs is seen on the trading floor at the New York Stock Exchange (NYSE) in New York City, New York, U.S., November 17, 2021. REUTERS/Andrew Kelly/File PhotoFor Goldman Sachs, SVB's botched stock sale had a silver lining

Goldman carried out only the first portion of that strategy. The illustrious investment bank needed more time after the bond portfolio purchase to persuade investors to lock in capital and dispel worries about depositors withdrawing money from SVB.

REUTER By Echo Wang, Lananh Nguyen and David FrenchNEW YORK, March 16 (Reuters) - As SVB Financial Group (SIVB.O) wrestled with a capital shortfall and the prospect of a downgrade to its credit rating last week, it went to Goldman Sachs Group Inc (GS.N) and worked out an unusual two-part plan, according to people familiar with the discussions.

The investment bank would buy a $21.5 billion bond portfolio from SVB to boost its coffers, after startups began pulling their deposits from the technology-focused lender, which does business as Silicon Valley Bank.

But there was a hitch. Goldman's offer for the portfolio was worth $1.8 billion less than the book value SVB had assigned to it, because a rise in interest rates had made it less valuable. SVB would have to book a loss on the portfolio, which comprised U.S. Treasuries and related bonds.

The next step was for Goldman to put together a solution. It would help organize a $2.25 billion stock sale for SVB to fill the funding gap caused by the bond portfolio sale, two of the sources said.

Goldman delivered on only the first step of that plan. Once the bond portfolio deal was completed, the storied investment bank didn't have time to convince investors to lock in capital and overcome concerns about depositors pulling money out of SVB.

The tight turnaround left insufficient time to prepare materials for investors by early last week, one of the sources said. The stock sale collapsed and SVB became the largest U.S. bank to fail since the 2008 financial crisis, fueling concern about other lenders and prompting regulatory interventions to backstop customer deposits.

Yet for Goldman, the botched deal had a silver lining. The bond portfolio it acquired from SVB is now worth more, based on the drop in Treasury yields since the transaction happened. Traders not affiliated with the deal that were interviewed by Reuters estimated the gain in value to be in the hundreds of millions of dollars. A source familiar with details of a hedge that Goldman's trading desk put on the deal said the gain would be less than $100 million.

It is unclear whether Goldman has held onto all or part of the bond portfolio or sold it. Goldman declined to comment. SVB did not respond to a request for comment. In a regulatory filing on Tuesday, SVB said its bond portfolio sales to Goldman were done at "negotiated prices".

Goldman was not paid the underwriting fee it had agreed for the stock sale because that deal fell through, two of the sources said. SVB has not disclosed how much that fee would have been.

Details provided by six people familiar with the attempted capital raise show that Goldman and SVB underestimated the challenges of pulling off the capital raise in terms of timing and investor interest. Only two private equity firms were ultimately invited to participate in the capital raise last week - General Atlantic and Warburg Pincus. SVB and Goldman hoped stock market investors would chip in for the remainder, four of the sources said.

Warburg Pincus turned down the deal, however, because it needed more time to carry out due diligence after it became concerned that SVB could still face long-term funding issues, two of the sources said. General Atlantic pledged $500 million, but walked away when the capital raise fell through.

Warburg Pincus and General Atlantic declined to comment.

The banks also miscalculated how investors would react to the stock sale. One of the sources said the company believed that investors would welcome the plan as a boon to SVB's financial health, but it backfired and instead sent a worrying signal that triggered a 60% plunge in the bank's shares. The mood of investors was already tense after another bank advised by Goldman, cryptocurrency-focused bank Silvergate Capital Corp (SI.N), collapsed the day before.

The handling of the SVB deal by Goldman, the most prolific dealmaker based on league table data, has attracted Wall Street's fascination and invited scrutiny.

Michael Ohlrogge, associate professor at the New York University School of Law, said that while Goldman may not have handled everything "exactly right", it had taken on a difficult assignment to begin with. "(SVB) had gotten themselves into such a risky position," Ohlrogge said.

UNDISCLOSED ROLE

SVB did not disclose in its stock sale prospectus to investors that Goldman was the acquirer of the bond portfolio it sold at a loss. But in the prospectus, SVB did mention other relationships and potential conflicts of interest, such as SVB's investment banking arm underwriting the deal.

SVB disclosed Goldman's role as acquirer of the bond portfolio only on Tuesday, the last day of a four-business day window that the U.S. Securities and Exchange Commission (SEC) affords companies to make such disclosures. Five securities lawyers interviewed by Reuters said that SVB's handling of the disclosure appeared to comply with the rules.

An SEC spokesperson did not respond to a request for comment.

Image: Germán & CoWhat does SVB’s collapse mean for other banks? Here’s what else might go wrong — and what to expect next.

Our finance and economics reporters teamed up with a banking regulation expert to answer reader questions on Reddit.

By POLITICO STAFF, 03/15/2023 The sweeping results of Biden’s actions last weekend prevented multimillion-dollar losses for thousands of companies that relied on Silicon Valley Bank. But the fallout from the largest bank failure since the 2008 financial crisis is still reverberating.

As regulators race to find a buyer willing to take on the bank’s domestic lending portfolio, some major companies are left scrambling to secure new lines of credit. Lobbyists are drawing battle lines as progressives in Congress push for tighter regulations. And Washington is still racing to calm investor fears of instability at other financial institutions.

Is it necessary that regional banks continue to exist? Why or why not?

This is a fantastic question. The U.S. has nearly 5,000 banks (and another 5,000 or so credit unions). That’s a lot of competition. Part of what’s strange though is a lot of that is a vestige of when we used to have restrictions on banking across state lines. So consolidation is perhaps understandable.

You don’t want too much concentration in the megabanks (think JPMorgan Chase or Bank of America, which each have more than $3 trillion in assets, compared to SVB, which had roughly $200 billion). And regional banks like SVB are probably better able to compete with those banks than the little guys. But there’s certainly room to debate whether we don’t need as many banks as we have now.

— Victoria Guida, POLITICO economics reporter covering the Federal Reserve, the Treasury Department and the broader economy

What regulations are being discussed, and what is the probability that any of these regulations will see the light of day? At this point, what is the likelihood that the SVB collapse is a contagion?

At this stage it’s extremely unlikely lawmakers would agree on a bill that would lead to any substantial changes — like Warren and Porter’s rollback of the Dodd-Frank rollback — that would make it across the finish line. Not enough Dems support it and it’s a divided Congress.

On the other hand, there are definitely signs that bank regulators are looking at things like capital requirements and better supervision. On the latter, one of the issues that’s been raised is that regulators didn’t spot the problems with SVB’s investment portfolio/depositor concentration. Fed Vice Chair Michael Barr is overseeing a review of that as we speak.

— Sam Sutton, POLITICO financial services reporter covering fintech and digital currencies

Do you think the decision to protect depositors, but not investors, is indicative of a new policy direction, or is this just a one-off due to the nature of SVB’s customer composition (an overwhelming number of large-ish employers)?

The legal answer to this is that there’s not a new policy. What actually happened is that the Fed, FDIC and Treasury invoked a “systemic risk exception” to the requirement that the FDIC try to minimize losses to its deposit insurance fund. That requires there to be some sort of threat to the financial system or the broader economy. (As an aside, the agencies haven’t really laid out their full justification for that, but the central reason seems to have been staving off financial panic.)

It might be hard to keep suggesting that every bank poses that kind of risk! And of course, that’s not what Congress has said — the deposit insurance limit is set at $250,000. That said, this could spur a change in deposit insurance law sometime in the future.

But the answer is actually more complicated than that. The Fed also unveiled an emergency lending program that, for the time being, will allow banks to put up the type of collateral that SVB dumped for cash loans that will help them meet withdrawal requests. So for now, the government has basically facilitated banks being able to handle more panicky behavior by depositors (although it depends on whether they have enough of the right type of assets). And that’s sort of an indirect backing of depositors for now!

— Victoria

Why was $1.8 billion in bond losses enough to make the bank insolvent? Where had all the deposits from clients gone that they couldn’t handle the bank run?

It had less to do with the losses than it did the depositors’ reaction to those losses. Remember this bank was pretty concentrated: Venture’s a big deal but it’s also a little bit of a small world. So when word got out that SVB was taking steps to repair its investment portfolio, depositors — startup founders, VCs, etc. — fled en masse. $42 billion gone in a day, which likely would’ve been more if CA regulators and FDIC didn’t step in. Hard to survive that kind of run.

— Sam

Are we expecting a chain reaction of more banks collapsing due to the global nature of panic these days?

The Fed has intervened to insulate open banks against liquidity concerns related to the open banks. Preventing a contagion likely played a role in invoking these systemic risk authorities for banks that are otherwise not central to the financial system. Crisis-fighters largely lost their authorities after the 2008 financial crisis to protect individual banks from contagion without first closing them. So, responding forcefully to these relatively insignificant banks’ failures hopefully limits contagion to any banks that may actually be more prone to spreading financial wildfire.

‘Your deposits are safe’: Biden assures public after Silicon Valley Bank collapse

The other thing worth noting is that this has primarily been a run on one kind of business model — banking tech/VC/Silicon Valley — which itself is facing belt-tightening as the Fed has raised interest rates steeply. We have not seen signs of contagion to large, diversified banks, which are actually experiencing deposit inflows.

— Steven Kelly, Senior Research Associate at the Program on Financial Stability at Yale University

How do you think this alters the FOMC’s plans for tightening? Do you think they have moved too fast? What else might break that they didn’t anticipate?

It will definitely be a major factor in how the Fed is thinking about what to do next on interest rates. Inflation is still high

— 6 percent over the past year — but it’s steadily dropped since the middle of last year. That said, it’s shown signs the last couple of months of mostly moving sideways rather than moving convincingly down.

All of that to say, this is a tricky place for the Fed. What we saw with the banks was an example of how rate moves can suddenly hit, with a delay, in unpredictable ways. And so they have to be worried about going too fast and breaking something else. But they might still do a small increase later this month because they’re still worried about inflation. It’s about risk management at this point.

— Victoria

Does this mark the beginning of the end for bank deregulation legislation that is framed as “right sized or tailored regulation”?

Unlikely. Tailoring as a broad and general concept is something that seems pretty logical: A community bank with less than $1 billion in assets that mostly does just basic lending shouldn’t face the same type of regulations as a megabank with $3 trillion in assets. How exactly that all shakes out is very complicated (and, as you implicitly suggest, offers a lot of room for mischief). But certainly, this has likely made both lawmakers and regulators much less sympathetic to arguments from banks — say, between $100 billion and $250 billion in size — that they don’t pose risks to the economy.

— Victoria

Was it really all that “shocking”? Seemed pretty expected something would happen with all the interest rate hikes, no?

Indeed, financial distress was definitely an expected outcome of the Fed’s interest rate hikes. They very explicitly wanted to tighten financial conditions — and banks are a huge part of the financial sector. The Fed is (awkwardly?) also in charge of bank supervision — i.e. making sure banks are resilient. And it has a financial stability mandate. It seems the Fed wants tighter financial conditions, but only outside the core banking system.

— Steven

What are SVB’s assets? Does the depositor’s refund come from bank reserves or the FDIC?

SVB’s assets are largely longer-term Treasuries and government-backed mortgage securities. These securities have little risk of loss if they’re held to maturity, but they lost paper value as interest rates increased. So when SVB lost deposits and had to sell assets, they had to bear those losses.

While depositors have immediate access to their funds — which may need to be funded in the short-term by the FDIC — the FDIC will only lose money if its sale of the assets (and/or liabilities) of SVB is less than enough to cover all the depositors. And, if the FDIC’s insurance fund dips below what it determines to be sufficient coverage for the system, it will levy the banking system for the shortcoming.

— Steven

What is the reason that Pacwest Bancorp has been hit hard during this? Their financials seem to suggest little doubts about liquidity.

Liquidity and capital regulations are helpful against general downside banking risks. They can do little if the market bails on your business model. PacWest’s business looks very similar to SVB’s even if their balance sheet looks stronger. Being a bank to tech/Silicon Valley doesn’t look like a viable business model in this interest rate environment - hence the counterparty run. When your counterparties run as a bank, you’re out of business. No amount of capital or liquidity can save you.

— Steven

Image: Germán & CoOil regains a bit of ground as Credit Suisse handed a lifeline

"As the U.S. banking crisis spread to Europe, market mood declined. Even though fundamentals may not necessarily be pointing in a bearish direction, the future movement will be determined by the level of market anxiety "In a client note, analysts from Haitong Futures stated.

Reuters by Laura Sanicola and Muyu Xu, editing Germán & CoMarch 16 - Oil prices clawed back some ground on Thursday after sliding to 15-month lows in the previous session as markets calmed somewhat after Credit Suisse (CSGN.S) was thrown a financial lifeline by Swiss regulators.

But battered by fears of a deepening crisis for banks worldwide, market sentiment remained fragile with both benchmarks giving up some early Thursday gains that saw Brent climb by more than $1.

As of 0639 GMT, Brent crude futures were up 59 cents or 0.8% to $74.28 per barrel. West Texas Intermediate crude futures (WTI) rose 49 cents or 0.7% to $68.10 a barrel.

On Wednesday, the third straight day of declines, U.S. crude fell below $70 a barrel for the first time since December 20, 2021.

Brent has lost nearly 10% since Friday's close, while U.S. crude is down about 11%.

"Considering (this) is really macro-driven rather than oil fundamentals-driven, WTI could flirt with the idea of bottoming out at $60. But I don't really see a full-blown collapse," said Viktor Katona, lead crude analyst at data analytics firm Kpler.

Credit Suisse on Thursday said it would borrow up to $54 billion from the Swiss central bank to shore up its liquidity and investor confidence after a slump in its shares intensified fears about a global financial crisis.

"Market sentiment deteriorated as the banking crisis expanded to Europe from the U.S...The future trend will depend on the level of market angst even if fundamentals are not necessarily showing much in the way of bearish signs," analysts from Haitong Futures said in a note to clients.

OPEC's rosier outlook for China oil demand also supported oil prices, said Lim Tai An, analyst at Phillip Nova Pte.

OPEC increased its Chinese demand forecast for 2023 earlier this week and a monthly report from the International Energy Agency (IEA) on Wednesday flagged an expected boost to oil demand from resumed air travel and China's economic reopening after abandoning its zero-COVID policy.

But oversupply concerns remain.

The IEA said in the report that commercial oil stocks in developed OECD countries have hit an 18-month high, while Russian oil output stayed near pre-war levels in February despite sanctions on its seaborne exports.

U.S. crude oil stockpiles also rose last week by 1.6 million barrels, exceeding analysts' expectation of a 1.2 million barrels rise, the Energy Information Administration said on Wednesday.

Later on Thursday, European Central Bank policymakers are seen leaning towards a half-percentage-point rate hike as the euro zone economy is picking up strength and inflation is set to remain high for years.

Higher interest rates can lead to depressed demand for oil as economic growth slows, but concerns about a widening financial crisis for the banking sector could also weigh on oil demand.

Image: Germán & Co by ShutterstockNord Stream owners discuss pipeline repairs, says E.ON

The operating company's main focus is the subject of how the two damaged pipelines can be first drained and sealed so that the strands do not further corrode.

Reuters, editing by Germán & CoESSEN, Germany, March 15 (Reuters) - Shareholders of the Nord Stream 1 pipeline operator are discussing how to seal and empty the damaged gas pipeline to halt corrosion from sea water, said the chief financial officer of E.ON (EONGn.DE), one of the owners.

The chief financial officer of E.ON (EONGn.DE), one of the stakeholders, told reporters at the group's results news conference that it was unclear whether the pipeline would be repaired but that any forthcoming decisions are likely to be made with the support of all shareholders.

"We continue to exercise our rights as a minority shareholder in the Nord Stream 1 operating company. And we still see no point in simply leaving the field to Gazprom at this point," E.ON's Marc Spieker said.

Nord Stream is majority owned by Russia's Gazprom (GAZP.MM), with other stakeholders including Wintershall DEA (WINT.UL) (BASFn.DE), Engie (ENGIE.PA) and Gasunie (GSUNI.UL).

E.ON on Wednesday said it had written off the value of its 15.5% stake in Nord Stream 1, the two strands of which were damaged by suspected sabotage in September.

The stake had initially been worth 1.2 billion euros ($1.3 billion), but its value was cut to zero in several steps.

"At the moment, the operating company is concentrating on the question of how the two destroyed pipelines can first be sealed and drained so that the strands do not corrode further," Spieker said.

Two sources familiar with the matter told Reuters this month that, while there was no plan to repair the ruptured pipeline, it would at least be conserved for possible reactivation in the future.

"Whether a repair will be attempted at some point in the future ... is completely speculative from today's point of view," Spieker said. "It depends on many factors - political, social, economic. Only time will tell."

Seaboard: pioneers in power generation in the country

…Armando Rodríguez, vice-president and executive director of the company, talks to us about their projects in the DR, where they have been operating for 32 years.

More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.