News round-up, April, 10, 2023

Quote of the day…

“Europeans cannot resolve the crisis in Ukraine; how can we credibly say on Taiwan, ‘watch out, if you do something wrong we will be there’? If you really want to increase tensions that’s the way to do it,” he said.

ABOARD COTAM UNITÉ (FRANCE’S AIR FORCE ONE) — Europe must reduce its dependency on the United States and avoid getting dragged into a confrontation between China and the U.S. over Taiwan, French President Emmanuel Macron said in an interview on his plane back from a three-day state visit to China. / POLITICO.EUMost read…

Europe must resist pressure to become ‘America’s followers,’ says Macron

The ‘great risk’ Europe faces is getting ‘caught up in crises that are not ours,’ French president says in interview.

POLITICO.EU bY JAMIL ANDERLINI AND CLEA CAULCUTT, APRIL 9, 2023 China’s new world order is taking shape

Macron gave Xi the optics he sought: A clear reminder to the United States — who Xi obliquely referred to as a domineering “third party” — of the gap between its hawkish stance on China and the more perhaps equivocating posture of many in Europe.

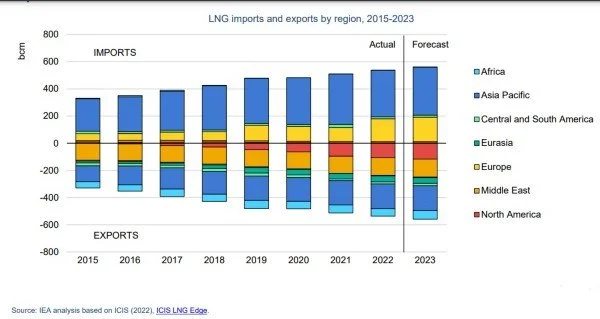

TWP, analysis by Ishaan Tharoor, Columnist, April 10, 2023Analysis: Europe facing costly winter without enough long-term LNG deals

Europe made the majority of purchases on the spot market, where prices are far higher than those agreed upon in long-term contracts preferred by seasoned purchasers like China. The International Energy Agency estimates that the cost of its LNG imports will more than treble to almost $190 billion in 2022.

REUTERS by Marwa Rashad and *Ron Bousso, TODAYHow the Latest Leaked Documents Are Different From Past Breaches

The freshness of the documents — some appear to be barely 40 days old — and the hints they hold for operations to come make them particularly damaging, officials say.

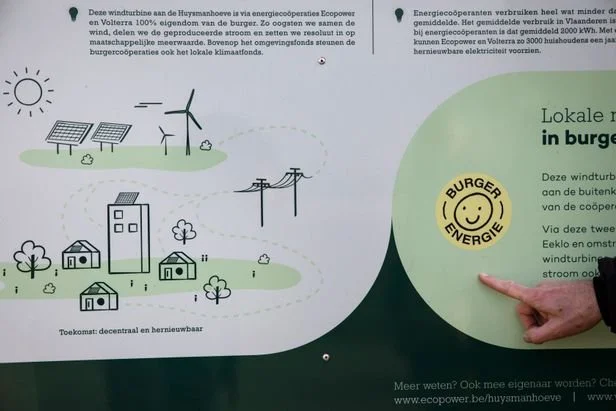

NYT by *David E. Sanger, April 9, 2023The Belgian Towns Producing Their Own Green Power

Energy prices in Europe have skyrocketed in the last year. But not in some towns in Belgium, where consumers have joined together to form co-ops and are generating their own sustainable electricity. It is a popular, and growing, model in Europe.

Spiegel, by Jan Petter in Eeklo, Belgium, 06.04.2023, Analysis: Western curbs on Russian oil products redraw global shipping map

As a result of the European Union ban on Russian fuel that started on Feb. 5, tankers carrying clean oil products such as gasoline, diesel, jet fuel and naphtha are travelling between 16 and 18 days to bring Russian supplies to Brazil or U.S. cargoes to Europe, according to two shipping sources.

REUTERS by Mohi Narayan and Jonathan Saul, TODAY“We’re living in a volatile world…

it’s easy to get distracted by things like changeable commodity prices or a shortage of solar panels. But this wouldn’t be true to our purpose – we can’t allow ourselves to lose sight of our end goal; said Andres Gluski, CEO of energy and utility AES Corp

Today's events

〰️

Today's events 〰️

"The great risk” Europe faces is getting "caught up in crises that are not ours," says Macron | Ludovic Marin/ AFP/ POLITICO.EUEurope must resist pressure to become ‘America’s followers,’ says Macron

The ‘great risk’ Europe faces is getting ‘caught up in crises that are not ours,’ French president says in interview.

POLITICO.EU bY JAMIL ANDERLINI AND CLEA CAULCUTT, APRIL 9, 2023 ABOARD COTAM UNITÉ (FRANCE’S AIR FORCE ONE) — Europe must reduce its dependency on the United States and avoid getting dragged into a confrontation between China and the U.S. over Taiwan, French President Emmanuel Macron said in an interview on his plane back from a three-day state visit to China.

Speaking with POLITICO and two French journalists after spending around six hours with Chinese President Xi Jinping during his trip, Macron emphasized his pet theory of “strategic autonomy” for Europe, presumably led by France, to become a “third superpower.”

He said “the great risk” Europe faces is that it “gets caught up in crises that are not ours, which prevents it from building its strategic autonomy,” while flying from Beijing to Guangzhou, in southern China, aboard COTAM Unité, France’s Air Force One.

Politico by Stuart LauXi Jinping and the Chinese Communist Party have enthusiastically endorsed Macron’s concept of strategic autonomy and Chinese officials constantly refer to it in their dealings with European countries. Party leaders and theorists in Beijing are convinced the West is in decline and China is on the ascendant and that weakening the transatlantic relationship will help accelerate this trend.

“The paradox would be that, overcome with panic, we believe we are just America’s followers,” Macron said in the interview. “The question Europeans need to answer … is it in our interest to accelerate [a crisis] on Taiwan? No. The worse thing would be to think that we Europeans must become followers on this topic and take our cue from the U.S. agenda and a Chinese overreaction,” he said.

Just hours after his flight left Guangzhou headed back to Paris, China launched large military exercises around the self-ruled island of Taiwan, which China claims as its territory but the U.S. has promised to arm and defend.

Those exercises were a response to Taiwanese President Tsai Ing-Wen’s 10-day diplomatic tour of Central American countries that included a meeting with Republican U.S. House Speaker Kevin McCarthy while she transited in California. People familiar with Macron’s thinking said he was happy Beijing had at least waited until he was out of Chinese airspace before launching the simulated “Taiwan encirclement” exercise.

Beijing has repeatedly threatened to invade in recent years and has a policy of isolating the democratic island by forcing other countries to recognize it as part of “one China.”

Taiwan talks

Macron and Xi discussed Taiwan “intensely,” according to French officials accompanying the president, who appears to have taken a more conciliatory approach than the U.S. or even the European Union.

“Stability in the Taiwan Strait is of paramount importance,” European Commission President Ursula von der Leyen, who accompanied Macron for part of his visit, said she told Xi during their meeting in Beijing last Thursday. “The threat [of] the use of force to change the status quo is unacceptable.”

Xi responded by saying anyone who thought they could influence Beijing on Taiwan was deluded.

Macron appears to agree with that assessment.

“Europeans cannot resolve the crisis in Ukraine; how can we credibly say on Taiwan, ‘watch out, if you do something wrong we will be there’? If you really want to increase tensions that’s the way to do it,” he said.

“Europe is more willing to accept a world in which China becomes a regional hegemon,” said Yanmei Xie, a geopolitics analyst at Gavekal Dragonomics. “Some of its leaders even believe such a world order may be more advantageous to Europe.”

In his trilateral meeting with Macron and von der Leyen last Thursday in Beijing, Xi Jinping went off script on only two topics — Ukraine and Taiwan — according to someone who was present in the room.

“Xi was visibly annoyed for being held responsible for the Ukraine conflict and he downplayed his recent visit to Moscow,” this person said. “He was clearly enraged by the U.S. and very upset over Taiwan, by the Taiwanese president’s transit through the U.S. and [the fact that] foreign policy issues were being raised by Europeans.”

In this meeting, Macron and von der Leyen took similar lines on Taiwan, this person said. But Macron subsequently spent more than four hours with the Chinese leader, much of it with only translators present, and his tone was far more conciliatory than von der Leyen’s when speaking with journalists.

‘Vassals’ warning

Macron also argued that Europe had increased its dependency on the U.S. for weapons and energy and must now focus on boosting European defense industries.

He also suggested Europe should reduce its dependence on the “extraterritoriality of the U.S. dollar,” a key policy objective of both Moscow and Beijing.

Macron has long been a proponent of strategic autonomy for Europe | Ludovic Marin/AFP via Getty Images

“If the tensions between the two superpowers heat up … we won’t have the time nor the resources to finance our strategic autonomy and we will become vassals,” he said.

Russia, China, Iran and other countries have been hit by U.S. sanctions in recent years that are based on denying access to the dominant dollar-denominated global financial system. Some in Europe have complained about “weaponization” of the dollar by Washington, which forces European companies to give up business and cut ties with third countries or face crippling secondary sanctions.

While sitting in the stateroom of his A330 aircraft in a hoodie with the words “French Tech” emblazoned on the chest, Macron claimed to have already “won the ideological battle on strategic autonomy” for Europe.

He did not address the question of ongoing U.S. security guarantees for the Continent, which relies heavily on American defense assistance amid the first major land war in Europe since World War II.

As one of the five permanent members of the U.N. Security Council and the only nuclear power in the EU, France is in a unique position militarily. However, the country has contributed far less to the defense of Ukraine against Russia’s invasion than many other countries.

As is common in France and many other European countries, the French President’s office, known as the Elysée Palace, insisted on checking and “proofreading” all the president’s quotes to be published in this article as a condition of granting the interview. This violates POLITICO’s editorial standards and policy, but we agreed to the terms in order to speak directly with the French president. POLITICO insisted that it cannot deceive its readers and would not publish anything the president did not say. The quotes in this article were all actually said by the president, but some parts of the interview in which the president spoke even more frankly about Taiwan and Europe’s strategic autonomy were cut out by the Elysée.

Iranian Foreign Minister Hossein Amirabdollahian holds hands with his Saudi Arabian counterpart, Prince Faisal bin Farhan al-Saud, and Chinese counterpart, Qin Gang, in Beijing on Thursday. (Ding Lin/Xinhua News Agency/AP)China’s new world order is taking shape

Macron gave Xi the optics he sought: A clear reminder to the United States — who Xi obliquely referred to as a domineering “third party” — of the gap between its hawkish stance on China and the more perhaps equivocating posture of many in Europe.

TWP, analysis by Ishaan Tharoor, Columnist, April 10, 2023It was a bumper week for diplomacy in Beijing. Chinese President Xi Jinping accompanied his French counterpart, President Emmanuel Macron, on a three-day visit to the Chinese capital and the southern metropolis of Guangzhou. Escaping, if briefly, from the fiery protests taking place in his own country, Macron was received by adoring, excited crowds of students at Guangzhou’s Sun Yat-sen University. In between grand receptions and formal tea ceremonies, the two leaders saw a slate of French companies and Chinese state-run firms clinch some major business deals.

Macron gave Xi the optics he sought: A clear reminder to the United States — who Xi obliquely referred to as a domineering “third party” — of the gap between its hawkish stance on China and the more perhaps equivocating posture of many in Europe. It was less clear what Xi gave Macron politically: The French president urged Xi to bring Russia “to reason” over its invasion of Ukraine, but that was met by boilerplate rhetoric and little indication of the needle of the conflict being moved in any significant direction.

In what was framed as a joint call with France, Xi urged for peace talks to resume soon and called “for the protection of civilians,” while also reiterating that “nuclear weapons must not be used, and nuclear war must not be fought” over Ukraine. That latter point marked perhaps the biggest distance between Xi and Russian President Vladimir Putin, who has periodically rattled the nuclear saber as the war he unleashed in Ukraine lurches on. Despite European entreaties, Xi made no definitive commitment to speak with Ukrainian President Volodymyr Zelensky.

Macron was joined in China by Ursula von der Leyen, president of the European Commission. The two leaders sent somewhat divergent messages; von der Leyen bemoaned China’s “unfair practices,” particularly in trade, and arrived in the country after delivering a tough speech on the authoritarian challenge posed by Beijing. Macron, on the other hand, warned against the West plunging itself into an “inescapable spiral” of tensions with China.

Chinese commentators suggested that’s because the tables of history have turned and Macron recognizes the sheer weight and importance of China’s economy, not least at a moment when he’s trying to carve out a vision of a more robust, capable and independent Europe. “Although there are still concerns in France about our country’s increasing [global] role, China’s support is essential if France wants to exercise its soft power in global governance,” Shanghai-based scholars Zhang Ji and Xue Sheng wrote in a recent essay.

Iranian Foreign Minister Hossein Amirabdollahian holds hands with his Saudi Arabian counterpart, Prince Faisal bin Farhan al-Saud, and Chinese counterpart, Qin Gang, in Beijing on Thursday. (Ding Lin/Xinhua News Agency/AP)

Macron and Europe hedge their bets on China

In the middle of Macron’s visit, another major summit took place in Beijing. The foreign ministers of Saudi Arabia and Iran — the Middle East’s feuding antagonists — conducted the highest-level meeting between their two countries in seven years in the Chinese capital. In Washington, a bemused clutch of regional experts looked on as China played the role of a stabilizing outside power in the Middle East.

The thaw between Riyadh and Tehran was long in the works and not exclusively because of Chinese efforts. “Analysts say the warming ties are due to a convergence of interests,” wrote my colleagues Kareem Fahim and Sarah Dadouch. “Iran, under Western sanctions and trying to suffocate a domestic protest movement, has looked to ease its global and regional isolation; Saudi Arabia, faced with security threats from Iran that threaten its plan to diversify the kingdom’s economy away from oil, is seeking to tamp down regional tensions — a strategy that has included pursuing partnerships with major world powers beyond the United States.”

But it does invariably show a waning of American influence, especially over the Saudis. “Many experts still assume that whoever is in the White House will guide Saudi policy on Iran, but that simply isn’t true today,” said Anna Jacobs, a senior Gulf analyst at the International Crisis Group, to the New York Times. “Saudi Arabia and Gulf Arab states are focusing on their economic, political and security interests and protecting themselves from regional threats.”

Enter Xi’s China, an economic juggernaut now flexing new geopolitical muscles. “China has in recent years declared that it needs to be a participant in the creation of the world order,” former U.S. secretary of state Henry Kissinger told Post columnist David Ignatius last month. “It has now made a significant move in that direction.”

China’s Xi promises to build ‘great wall of steel’ in rivalry with West

The contours of this imagined Chinese world order are still difficult to sketch. We know about its vast economic ambitions, including the Belt and Road Initiative that has seen China finance and invest in major infrastructure projects around the world. But in recent weeks, Xi has touted a number of other new initiatives over “security” and “civilization” — still vague policy positions essentially challenging the architecture of the U.S.-led order, as well as the concept of universal values.

“It appears to be a counterargument to [President] Biden’s autocracy versus democracy narrative,” Moritz Rudolf, a research scholar at Yale Law School’s Paul Tsai China Center, told the Financial Times. “It’s an ideological battle that’s more attractive to developing countries than people in Washington might believe.”

China’s foray into Middle East great power politics, in particular, show a new capacity and willingness to act. “In the past we would declare some principles, make our position known but not get involved operationally. That is going to change,” said Wu Xinbo, dean of the Institute of International Studies at Fudan University in Shanghai, said in the same Financial Times story.

For some analysts, Macron’s visit is a reminder of the tough questions facing Europe. While the war in Ukraine and antipathy toward Russia have galvanized the transatlantic alliance, the question of China is thornier, with Chinese investment and trade vital to Europe’s future prospects. What that means for the grim scenarios that obsess Washington policymakers — including a possible future Chinese invasion of Taiwan — is an open question, and one that may elicit unwelcome answers on both sides of the pond.

“The paradox would be that, overcome with panic, we believe we are just America’s followers,” Macron told reporters traveling with him, before gesturing to current tensions over Taiwan. “The question Europeans need to answer … is it in our interest to accelerate [a crisis] on Taiwan? No. The worse thing would be to think that we Europeans must become followers on this topic and take our cue from the U.S. agenda and a Chinese overreaction.”

“What happens in Europe now — not just in terms of the outcome of this war [in Ukraine], but how Europeans define their relations with China in the future — will shape transatlantic relations,” wrote Andrew Michta, a nonresident senior fellow at the Atlantic Council. “And Europe’s choices when it comes to its China policy will greatly influence the outcome of U.S. competition with China in other theaters too.”

A global order defined — or heavily sculpted — by Beijing’s one-party regime would not be an attractive prospect to most countries. China is, in the Economist’s gloomy analysis, a would-be “superpower that seeks influence without winning affection, power without trust and a global vision without universal human rights.”

But its greater clout on the world stage need not always ring alarm bells. “Not everything between the U.S. and China has to be a zero-sum game,” Sen. Chris Murphy (D-Conn.), who leads the Senate Foreign Relations Committee’s Middle East panel, told Politico in the context of Beijing’s Middle East diplomacy. “I don’t know why we would perceive there to be a downside to de-escalation between Saudi Arabia and Iran.”

Image: A general view shows a special ship, "Neptune", the floating liquefied natural gas terminal, during the inauguration of the Liquefied Natural Gas (LNG) terminal 'Deutsche Ostsee' in the port of Lubmin, Germany January 14, 2023. REUTERS/Annegret HilseAnalysis: Europe facing costly winter without enough long-term LNG deals

Europe made the majority of purchases on the spot market, where prices are far higher than those agreed upon in long-term contracts preferred by seasoned purchasers like China. The International Energy Agency estimates that the cost of its LNG imports will more than treble to almost $190 billion in 2022.

REUTERS by Marwa Rashad and *Ron BoussoLONDON, April 6 (Reuters) - Europe has not made enough progress in locking in long-term contracts for liquefied natural gas (LNG) as an alternative to Russian pipeline supply, which may prove costly next winter as a rebound in Chinese demand could sharply tighten the market.

Buying LNG to replace curtailed Russian flows helped the bloc weather the first winter of the Ukraine conflict, with Europe importing 121 million tonnes of the fuel in 2022, a 60% increase from 2021.

But that came at a cost: Europe bought largely on the spot market, where prices are much higher than those negotiated under long-term deals favoured by seasoned buyers like China. According to the International Energy Agency, the cost of its LNG imports more than tripled in 2022 to some $190 billion.

Northweat Europe LNG imports Northwest Europe LNG importsAnalysts estimate that Europe accounted for more than a third of global spot market trades in 2022, from around 13% in 2021. Such exposure could reach more than 50% this year if no long-term contracts were signed.

But Europe's climate goals - the EU aims to cut net emissions at least 55% by 2030, and to reach net zero by 2050 - mean its LNG buyers struggle to commit to the timeframes necessary to lock in LNG more cheaply under contract.

Morten Frisch, senior partner at Morten Frisch Consulting, said Europe ideally needs about 70-75% of its LNG supply under firm long-term sale and purchase agreements (SPAs).

"But since the green lobby in Europe has managed to persuade politicians wrongly that hydrogen to a large extent can replace natural gas as an energy carrier by 2030, Europe has become far too reliant on spot and short term purchases of LNG," he added.

One senior supply-side source reported a "disconnection" during negotiations with European companies between their needs and the messages they get from their governments on climate.

"Some customers struggle internally... (wondering) is there is a hard stop in 2030? Is there a net-zero by 2040? This moving target... is it really a cliff?" he said.

"This makes it tough for them to commit to the medium and longer term deals, and that potentially leaves them exposed to the spot market in the future."

SECURITY OF SUPPLY

Asia has continued to pull ahead in the race for limited global LNG supply this year before new flows come into the market in 2025 and beyond.

"Their preference for security of supply has allowed them to continue to support new projects, whereas European buyers are concerned about committing to supply well into the start of their net-zero targets," said Felix Booth, head of LNG at energy intelligence firm Vortexa.

China's LNG imports China's LNG importsWhile gas is a fossil fuel, it produces less carbon dioxide emissions than coal, so some EU states see it as a temporary alternative to replace dirtier fuels.

Eurasia Group's managing director for energy, climate and sustainability Raad Alkadiri said Europe will not be able to lock in LNG as a replacement for Russian gas as long as the EU views it as a transition fuel, as producers want a guaranteed market in Europe over the next few decades.

LNG imports and exports by region LNG imports and exports by regionSpot LNG prices have dropped more than 82% since they hit a record $70.50 per million British thermal units (mmBtu) in 2022 after Russia’s invasion of Ukraine.

LNG spot market prices LNG spot market pricesBut they are expected to rise again, with a hot summer that could cut hydro levels, a cold 2023-2024 winter and a rebound in Chinese LNG demand all seen as among the risk factors for price.

"EU companies would need to act first by signing a series of large-scale, long-term SPAs based on the Chinese model, to hedge themselves against any ups and downs of the turbulent global LNG market," said Victor Tenev, LNG business consultant at advisory ROITI Ltd.

"Failing to hedge their unenviable natural short position would leave the EU exposed again to the damagingly expensive spot market."

TRANSITION

Major LNG producers and traders including QatarEnergy, Shell, Chevron and ConocoPhillips have in recent months all held talks in European capitals on securing LNG deals.

QatarEnergy's talks with the German government and top power companies such as RWE have hit a wall due to disagreements over deal length, company and industry sources said.

While Qatar typically seeks to sign contracts with at least 25-year terms, Germany has sought a term of 10 to 15 years due to its commitments to slash greenhouse gas emissions, the sources said.

"If you take gas with the delivery point Germany, you cannot go beyond 2043, because gas is not allowed in Germany after 2043," a senior German industry source said.

To resolve the issue, Qatar has offered Germany shorter term contracts of 15 years which would price the LNG at a hefty premium to the longer-term contract, the sources said.

"Nobody wants to lock in 20 years nowadays, and it's the worst possible idea when you're trying to work out what's going to happen next year," Shell Chief Financial Officer Sinead Goreman said at a conference in March.

Shell is offering supply contracts with "break clauses" to allow changes to contracts' term and destination throughout the life of the supply deal such as a three, five or 10 year mark, she said.

"That's what you are going to see more and more - the big integrated players... (being) willing to take that risk because ultimately, countries and smaller companies want to have the flexibility to say, well, let's see how fast renewables grow."

*Thomson Reuters

Ron has covered since 2014 the world’s top oil and gas companies, focusing on their efforts to shift into renewables and low carbon energy and the sector's turmoil during the COVID-19 pandemic and following Russia's invasion of Ukraine. He has been named Reporter of the Year in 2014 and 2021 by Reuters. Before Reuters, Ron reported on equity markets in New York in the aftermath of the 2008 financial crisis after covering conflict and diplomacy in the Middle East for AFP out of Israel.Seaboard: pioneers in power generation in the country

…Armando Rodríguez, vice-president and executive director of the company, talks to us about their projects in the DR, where they have been operating for 32 years.

More than 32 years ago, back in January 1990, Seaboard began operations as the first independent power producer (IPP) in the Dominican Republic. They became pioneers in the electricity market by way of the commercial operations of Estrella del Norte, a 40MW floating power generation plant and the first of three built for Seaboard by Wärtsilä.

Leaked documents leave no doubt about how heavily the United States in involved in the war in Ukraine.Credit...Stefani Reynolds for The New York TimesNEWS ANALYSIS

How the Latest Leaked Documents Are Different From Past Breaches

The freshness of the documents — some appear to be barely 40 days old — and the hints they hold for operations to come make them particularly damaging, officials say.

NYT by *David E. Sanger, April 9, 2023When WikiLeaks spilled a huge trove of State Department cables 13 years ago, it gave the world a sense of what American diplomats do each day — the sharp elbows, the doubts about wavering allies and the glimpses at how Washington was preparing for North Korea’s eventual collapse and Iran’s nuclear breakout.

When Edward Snowden swept up the National Security Agency’s secrets three years later, Americans suddenly discovered the scope of how the digital age had ushered in a remarkable new era of surveillance by the agency — enabling it to pierce China’s telecommunications industry and to drill into Google’s servers overseas to pick up foreign communications.

The cache of 100 or so newly leaked briefing slides of operational data on the war in Ukraine is distinctly different. The data revealed so far is less comprehensive than those vast secret archives, but far more timely. And it is the immediate salience of the intelligence that most worries White House and Pentagon officials.

Some of the most sensitive material — maps of Ukrainian air defenses and a deep dive into South Korea’s secret plans to deliver 330,000 rounds of much-needed ammunition in time for Ukraine’s spring counteroffensive — is revealed in documents that appear to be barely 40 days old.

It is the freshness of the “secret” and “top secret” documents, and the hints they hold for operations to come, that make these disclosures particularly damaging, administration officials say. On Sunday, Sabrina Singh, a Pentagon spokeswoman, said U.S. officials had notified congressional committees of the leak and referred the matter to the Justice Department, which had opened an investigation.

The 100-plus pages of slides and briefing documents leave no doubt about how deeply enmeshed the United States is in the day-to-day conduct of the war, providing the precise intelligence and logistics that help explain Ukraine’s success thus far. While President Biden has barred American troops from firing directly on Russian targets, and blocked sending weapons that could reach deep into Russian territory, the documents make clear that a year into the invasion, the United States is heavily entangled in almost everything else.

It is providing detailed targeting data. It is coordinating the long, complex logistical train that delivers weapons to the Ukrainians. And as a Feb. 22 document makes clear, American officials are planning ahead for a year in which the battle for the Donbas is “likely heading toward a stalemate” that will frustrate Vladimir V. Putin’s goal of capturing the region — and Ukraine’s goal of expelling the invaders.

One senior Western intelligence official summed up the disclosures as “a nightmare.” Dmitri Alperovitch, the Russia-born chairman of Silverado Policy Accelerator, who is best known for pioneering work in cybersecurity, said on Sunday that he feared there were “a number of ways this can be damaging.” He said that included the possibility that Russian intelligence is able to use the pages, spread out over Twitter and Telegram, “to figure out how we are collecting” the plans of the G.R.U., Russia’s military intelligence service, and the movement of military units.

In fact, the documents released so far are a brief snapshot of how the United States viewed the war in Ukraine. Many pages seem to come right out of the briefing books circulating among the Joint Chiefs of Staff, and in a few cases updates from the C.I.A.’s operations center. They are a combination of the current order of battle and — perhaps most valuable to Russian military planners — American projections of where the air defenses being rushed into Ukraine could be located next month.

Mixed in are a series of early warnings about how Russia might retaliate, beyond Ukraine, if the war drags on. One particularly ominous C.I.A. document refers to a pro-Russian hacking group that had successfully broken into Canada’s gas distribution network and was “receiving instructions from a presumed Federal Security Service (F.S.B.) officer to maintain network access to Canadian gas infrastructure and wait for further instruction.” So far there is no evidence that Russian actors have begun a destructive attack, but that was the explicit fear expressed in the document.

Because such warnings are so sensitive, many of the “top secret” documents are limited to American officials or to the “Five Eyes” — the intelligence alliance of the United States, Britain, Australia, New Zealand and Canada. That group has an informal agreement not to spy on the other members. But it clearly does not apply to other American allies and partners. There is evidence that the United States has plugged itself into President Volodymyr Zelensky’s internal conversations and those of even the closest U.S. allies, like South Korea.

In a dispatch that is very reminiscent of the 2010 WikiLeaks disclosures, one document based on what is delicately referred to as “signals intelligence” describes the internal debate in Seoul over how to handle American pressure to send more lethal aid to Ukraine, which would violate the country’s practice of not directly sending weapons into a war zone. It reports that South Korea’s president, Yoon Suk Yeol, was concerned that Mr. Biden might call him to press for greater contributions to Ukraine’s military.

It is an enormously sensitive subject among South Korean officials. During a recent visit to Seoul, before the leaked documents appeared, government officials dodged a reporter’s questions about whether they were planning to send 155-millimeter artillery rounds, which they produce in large quantities, to aid in the war effort. One official said South Korea did not want to violate its own policies, or risk its delicate relationship with Moscow.

Now the world has seen the Pentagon’s “delivery timeline” for sea shipments of those shells, along with estimates of the cost of the shipments, $26 million.

With every disclosure of secret documents, of course, there are fears of lasting damage, sometimes overblown. That happened in 2010, when The New York Times started publishing a series called “State’s Secrets,” detailing and analyzing selected documents from the trove of cables taken by Chelsea Manning, then an Army private in Iraq, and published by Julian Assange, the WikiLeaks founder. Soon after the first articles were published, Secretary of State Hillary Clinton expressed fear that no one would ever talk to American diplomats again.

“In addition to endangering particular individuals, disclosures like these tear at the fabric of the proper function of responsible government,” she told reporters in the Treaty Room of the State Department. Of course, they did keep talking — though many foreign officials say that when they speak today, they edit themselves with the knowledge that they may be quoted in department cables that leak in the future.

When Mr. Snowden released vast amounts of data from the National Security Agency, collected with a $100 piece of software that just gathered up archives he had access to at a facility in Hawaii, there was similar fear of setbacks in intelligence collection. The agency spent years altering programs, at a cost of hundreds of millions of dollars, and officials say they are still monitoring the damage now, a decade later. In September, Mr. Putin granted Mr. Snowden, a low-level intelligence contractor, full Russian citizenship; the United States is still seeking to bring him back to face charges.

But both Ms. Manning and Mr. Snowden said they were motivated by a desire to reveal what they viewed as transgressions by the United States. “This time it doesn’t look ideological,” Mr. Alperovitch said. The first appearance of some of the documents seems to have taken place on gaming platforms, perhaps to settle an online argument over the status of the fight in Ukraine.

“Think about that,” Mr. Alperovitch said. “An internet fight that ends up in a massive intelligence disaster.”

*David E. Sanger is a White House and national security correspondent. In a 38-year reporting career for The Times, he has been on three teams that have won Pulitzer Prizes, most recently in 2017 for international reporting. His newest book is “The Perfect Weapon: War, Sabotage and Fear in the Cyber Age.” Jan de Pauw: "Personally, I just didn’t want my money heading to a French company month after month." Foto: Mashid Mohadjerin / DER SPIEGELThe Belgian Towns Producing Their Own Green Power

Energy prices in Europe have skyrocketed in the last year. But not in some towns in Belgium, where consumers have joined together to form co-ops and are generating their own sustainable electricity. It is a popular, and growing, model in Europe.

Spiegel, by Jan Petter in Eeklo, Belgium, 06.04.2023, *Global Societies

For our Global Societies project, reporters around the world will be writing about societal problems, sustainability and development in Asia, Africa, Latin America and Europe. The series will include features, analyses, photo essays, videos and podcasts looking behind the curtain of globalization. The project is generously funded by the Bill & Melinda Gates Foundation.

Along with 65,000 other households, the couple are members of Belgium’s largest energy co-operative. The co-op produces and delivers green energy to its members at cost. When compared to the large corporations in the industry, Ecopower is just a dwarf, but it is a popular one. Last year, three times more people wanted to join the co-operative than could be supplied with electricity. At the moment, Ecopower is no longer accepting members.

Bernadette Vandercammen in her home. "It is important to me that the profits stay here in Eeklo."Foto: Mashid Mohadjerin / DER SPIEGELThe co-operative has its roots in Eeklo, Vandercammen’s hometown in northern Flanders. The "Eco" in the name once stood for the ecological convictions of its founders. These days, though, the name can easily be understood as a reference to the sustainable energy it produces. In the current energy crisis, Ecopower and other co-operatives offer reliability. Whereas others engage in speculation, jack up prices out of fear or throw out customers, Ecopower continues to provide cheap energy from renewable sources.

"We make long-term contracts," says Jan de Pauw, who works for Ecopower as a project developer. "We only provide energy to our members at a dependable price, without earning much profit." It’s also a rather small operation, regionally focused instead of seeking to expand multi~nationally. Many of its customers live within sight of the wind turbines and solar farms from which they get their energy.

Excellent Wind Power Conditions

Belgium is a leader when it comes to the concept of energy co-ops. In part, as de Pauw says during a tour of a facility, because of the conditions. After Denmark, he notes, Belgium is home to the best conditions in Europe for harnessing wind energy. He gestures to the flat, expansive fields, across which the wind blows down from the North Sea. But there are also other reasons. "Personally, I just didn’t want my money going to a French company month after month," says de Pauw.

Belgium is divided into French-speaking Wallonia and Dutch-speaking Flanders. The differences between the two populations have produced a sense of regional pride, with many needs being met locally. Including, in this case, the production of sustainable energy. Despite the local focus, however, de Pauw is convinced that the model could provide a more universal solution that would work in large parts of Europe and beyond.

Jan De Pauw: "The one wind turbine only benefits the company to which it belongs. The other is ours, and we pay out 10,000 euros per year from it to the people who live here."Foto: Mashid Mohadjerin / DER SPIEGELOne reason he highlights is the extremely small number of protests against the wind turbines that the Ecopower co-operative has erected here. De Pauw has collected the data to prove it: "Ten times fewer" complaints were lodged against Ecopower’s plans when compared to conventional projects, he claims. "Even those who weren’t members of the co-op accepted the projects."

The "not-in-my-backyard" (NIMBY) problem is one that has dogged the expansion of windfarms in many parts of Europe in recent years. In Bavaria, for example, complaints from locals have led to a situation in which the installation of wind power facilities has come to a virtual standstill. In Eeklo, by contrast, new wind turbines go up all the time, with 14 of them recently being added. The city produces more green energy than it consumes.

Wind turbines on the outskirts of Eeklo. The town now produces more energy than it consumes.Foto: Mashid Mohadjerin / DER SPIEGELSupport from locals is far from being just some sort of Flemish tic, says de Pauw. Locals know that the expansion of wind power benefits everybody in town. "Our offer is simply better."

To demonstrate his approach, he points to two different wind turbines of the exact same model, both of which reach 120 meters into the sky, their rotors gently humming as they turn. "What is the difference between the two?" de Pauw asks, his arm outstretched. He immediately answers his own question: "The one wind turbine only benefits the company to which it belongs. The other is ours, and we pay out 10,000 euros per year from it to the people who live here."

Cheaper and Sustainable

To convince locals of the value of his co-op, he organized a number of town hall meetings over the course of several months to explain the concept and respond to concerns. Ultimately, Ecopower and Eeklo agreed to a joint concept: For each wind turbine, the operators pay 5,000 euros into a local fund for climate protection each year and the same amount into a community fund for other needs. In addition, Ecopower has agreed to finance an engineer for the city for 20 years, whose job it is to help the town shift to renewable energy sources and develop a district heating system. That engineer is de Pauw himself.

Overall, the co-op isn’t particularly expensive, and it benefits the community. In recent years, electricity from Ecopower was only slightly cheaper than that from conventional providers. It was a model for sustainability, not necessarily for saving significant amounts of money. But ever since electricity prices have skyrocketed as a result of the war in Ukraine and other factors, it has been both. Whereas the large providers have tripled their prices in some cases, the co-op has only made slight increases to cover infrastructure and management costs. The basic price of electricity from their wind turbines, by contrast, only has to cover construction and maintenance costs. It remains constant for 20 years.

Bob D'Haeseleer: "Ecopower was a godsend for our community."Foto: Mashid Mohadjerin / DER SPIEGELBob D’Haeseleer, who was deputy mayor of Eeklo when Ecopower was set up, closely followed the co-op’s development for nearly 10 years. "Ecopower was a godsend for our community," he says. "It saved us from a number of destructive debates and brought more revenues to the city than a conventional provider." He says the city council vote to participate in the deal with the co-op and expand wind power was unanimous.

More recently, though, the mood in Eeklo has soured somewhat. Farmers are fighting about who is allowed to sell property to wind turbine operators. The district heating network, which was to become part of the co-op and be built with the corporation Veolia, hasn’t come to fruition. And the electricity providers who won the concession for the wind park along with Ecopower aren’t paying into the local fund as promised, says D’Haeseleer. Still, even though Eeklo has run into some problems, the concept of energy co-ops is gaining in popularity elsewhere in Europe.

A plaque next to an Ecopower wind turbine explains the idea behind the co-op.Foto: Mashid Mohadjerin / DER SPIEGELSince 2019, the European Commission has been seeking to expand energy co-ops into an additional pillar of the European electricity supply. And the arguments in Brussels are the same as those in Eeklo: greater local support and participation and a more responsible approach to energy.

Heading Offshore

Ecopower is now setting up a European association of comparable organizations, with their number having multiplied in recent years. In countries like Spain, Britain and Germany, people are joining forces in organizations to produce energy. In addition to pure co-ops, there is also an increasing number of FinCoops, energy companies that customers can invest in to earn dividends.

"Despite the successes, we need to stay realistic," says de Pauw. "We're an additional pillar. A very important one, but for now, we cannot and do not want to take over the entire energy market." Currently co-ops are supplying only 2 percent of households in Belgium. That share, though, is almost certain to rise in coming years, with the participation of co-ops in new projects now legally mandated.

In a model European Union project, 100 needy families are currently receiving co-op shares instead of cost subsidies. Ecopower customers, says de Pauw, are twice as thrifty as other power consumers, so involving needy families in co-ops could facilitate the exchange of tips and ideas for awareness when it comes to energy consumption.

But the biggest upcoming project is elsewhere. Together with 32 other Belgian co-ops, Ecopower is planning to build an offshore wind park off the coast of Belgium. The plan calls for 240 wind turbines producing 15 megawatts of electricity each, eight times more powerful than the facilities in Eeklo. The call for tender is currently underway. The co-ops are to pool 450 million euros in a consortium. Should the plan ever become reality, the park would produce enough electricity for 800,000 households.

For Bernadette Vandercammen, though, other elements of the energy co-op are more important. "It is important to me that the profits stay here in Eeklo," she says.

*This piece is part of the Global Societies series. The project runs for three years and is funded by the Bill & Melinda Gates Foundation.Oil is pumped into an oil tanker at the Ust-Luga oil products terminal in the settlement of Ust-luga, April 9, 2014. REUTERS/Alexander Demianchuk/File PhotoAnalysis: Western curbs on Russian oil products redraw global shipping map

As a result of the European Union ban on Russian fuel that started on Feb. 5, tankers carrying clean oil products such as gasoline, diesel, jet fuel and naphtha are travelling between 16 and 18 days to bring Russian supplies to Brazil or U.S. cargoes to Europe, according to two shipping sources.

REUTERS by Mohi Narayan and Jonathan Saul, TODAYNEW DELHI/LONDON, April 6 (Reuters) - Global fuel suppliers are turning to longer and costlier routes that produce more carbon emissions to move their diesel and other products as Western restrictions on Russian cargoes have reshuffled global energy shipping patterns.

As a result of the European Union ban on Russian fuel that started on Feb. 5, tankers carrying clean oil products such as gasoline, diesel, jet fuel and naphtha are travelling between 16 and 18 days to bring Russian supplies to Brazil or U.S. cargoes to Europe, according to two shipping sources.

That is up from the four to six days a ship used to travel from Russia to Europe, said the two sources, a broker at a major shipbroking firm and a charterer involved in the Russian trade of naphtha, which is used to make plastics and petrochemicals.

The ban comes on top of a halt late last year on Russian crude sales into the bloc as well as Western price caps.

Since the start of the ban, the Clean Tanker Index published by the Baltic Exchange, which measures average freight rates for shipping fuels like gasoline and diesel on some of the most common global routes, has more than doubled.

The redrawing of the shipping map underscores the knock-on effects of Western efforts to punish Russia over its invasion of Ukraine last year, adding to fuel supply insecurity and pushing up prices even as policymakers worry about inflation and the risk of a global economic downturn.

"Not only are voyages much longer, but vessel behaviour has also changed, keeping vessels from operating in other CPP (clean petroleum product) markets," Dylan Simpson, freight analyst at oil analytics firm Vortexa, wrote in a March 31 note.

Russian cargoes of fuel are heading to far-flung buyers in Brazil, Turkey, Nigeria, and Morocco as Moscow compensates for the lost European business, while Europe is importing more fuels such as diesel from Asia and the Middle East, according to shipping data from Refinitiv and Kpler.

Asian cargoes, in turn, are being displaced by Russian fuels in Africa and the eastern Mediterranean, and redirected to the blending hub of Singapore for temporary storage, two northeast Asian refinery sources said.

Naphtha trade route before Russia-Ukraine crisisEuropean importers whose naphtha cargoes travelled from Russian ports to Antwerp in four days before Russia's invasion of Ukraine now must wait 18 days for alternative supplies from the United States, the shipbroking source said.

Naphtha trade route before Russia-Ukraine crisis

The U.S. is also emerging as a top supplier of heavy naphtha to Europe amid the EU ban, while the Group of Seven Nations, EU and Australia have capped Russian naphtha prices at $45 a barrel and diesel and gasoline at $100 a barrel for trades that use Western ships and insurance. Meanwhile, Brazil, traditionally a U.S. naphtha importer, is boosting purchases from Russia at more attractive prices.

However, the journey from Russia to Brazil can take 18 days or longer and, at up to $7 million per voyage, the costs are nearly double that of a U.S. shipment, the ship charterer involved in the Russian market said.

Brazil received around 240,000 tonnes of Russian diesel and gasoil in the first three weeks of March, accounting for a quarter of Brazilian imports, up from Russia's 12% share in February and less than 1% last year, said Benedict George, head of diesel pricing with energy and commodity data provider Argus.

"Until February, Europe had remained Russia's primary market for refined product exports; however, in the space of a month, a major pivot has been observed," tanker broker E A Gibson said in a recent report.

Naphtha trade routes after Russia-Ukraine crisis unfoldedLONGER DISTANCES, MORE POLLUTION

Measured in terms of cargo miles, which multiplies the cargo quantity in metric tonnes by the distance travelled in nautical miles, the amount of Russian oil product shipments to Brazil in March rose to 3.07 billion metric tonne-nautical miles (MT-NM) from 941 million MT-NM in November, according to data from valuation company VesselsValue. Shipments from Russia to Nigeria rose to 1.88 billion MT-NM in March from zero in November, VesselsValue estimates showed.

Clean product cargoes to Saudi Arabia in March jumped to 1.75 billion MT-NM from 31 million MT-NM in November, while shipments to the United Arab Emirates were 4.43 billion MT-NM in March, up from 2.85 billion MT-NM in November, the data showed.

Also in March, Russian clean products shipped to Togo reached 973 million MT-NM, up from zero in November. In volume terms, Brazilian imports of oil products from Russia were about 284,000 metric tonnes in February, up from 73,300 tonnes in September, VesselsValue data showed. Conversely, Russian exports to the Netherlands dropped to 238,200 tonnes in February from 1.15 million tonnes in September.

Those longer distances are being done at higher costs for Russian products than for typical shipments from Europe.

According to market estimates, freight rates for the UK/European continent to West Africa are quoted at $55.77 per tonne for a product tanker with a standard 37,000-tonne load. This compares with an indicative rate of $174.24 per tonne for shipments from Russia's Baltic ports to Nigeria, $103.84 for Morocco and around $150 to Egypt.

With ships travelling further, that is also likely translating into greater emissions from smokestacks.

Based on pre-pandemic data, a 10% increase in mileage for all tankers travelling to and from the European economic area would increase their emissions by around 1.5 million tonnes of carbon dioxide, equal to the emissions of around 750,000 cars per year in Europe, said Valentin Simon, data analyst with the Transport & Environment think tank in Brussels.

Image: Germán & Co