The Fukushima nuclear accident significantly affected natural gas prices…

Check out the article from Energy Central at www.energycentral.com for more helpful information about the changing energy industry.In December 2023, Energy Central recognized outstanding contributors in the Energy & Sustainability Network at the 'Top Voices' event. Winners were celebrated in six articles, highlighting the community's appreciation for their valuable contributions. The platform offers industry professionals a space to display their work, engage with colleagues, and work with prominent figures. Congratulations to the 2023 Top Voices: David Hunt, Germán Toro Ghio, Schalk Cloete, and Dan Yurman, showcasing their expertise. - Matt Chester, Energy Central

Picture by Germán & Co via Shuttersock"By Germán & Co...As Japan made the decision to shut down its nuclear plants, the subsequent surge in demand for fuel led to a significant spike in natural gas prices. This change, however, created an opening for U.S. companies to capitalize on by converting import terminals into export terminals, resulting in a remarkable increase in gas exports from the U.S. Consequently, this pivotal shift has not only brought substantial profits to oil and gas companies but has also served to bolster American influence worldwide. Despite the positive implications of this development, environmental activists have raised valid concerns about the impact of the surge in liquefied natural gas exports on global warming.

Interestingly, in the early 2000s, many major companies made substantial investments, to the tune of billions of dollars, in the construction of terminals designed to import natural gas from countries such as Qatar and Australia due to the scarcity of domestic natural gas. However, the landscape shifted dramatically with the advancement of fracking techniques, which granted U.S. drillers access to vast reserves of cost-effective natural gas from shale rock. This game-changing opportunity swiftly propelled the U.S. from a relatively insignificant gas exporter to the top spot as the world's leading supplier within a remarkably short span of eight years.

Therefore, it is of utmost importance to thoroughly assess and understand the environmental implications of natural gas exports, all the while ensuring a delicate equilibrium with the economic advantages they bring. Amidst the increasing investments by U.S. companies to transition import terminals into export facilities, the Biden administration's decision to temporarily pause the authorization of new liquefied natural gas export sites stands as a pivotal move in scrutinizing their effects on climate change, the economy, and national security. Nevertheless, the foreseeable future holds the prospect of the U.S. potentially doubling its export capacity by the year 2027, attributed to the continuation of ongoing approved and in-progress ventures, alongside the contemplation of further expansions.

How the U.S. Became the World’s Biggest Gas Supplier…

Picture by Germán & Co via ShuttersockTop exporters of liquefied natural gas

12 billion cubic feet per dayThe data shows the average yearly exports of liquefied natural gas by country, based on S&P Global.The New York Times article by Brad Plumer and Nadja Popovich on February 2, 2024.In just eight years, the United States has rocketed from barely selling any gas overseas to becoming the world’s No. 1 supplier, a remarkable shift that has profited oil and gas companies and strengthened American influence abroad. But climate activists worry that soaring exports of liquefied natural gas could make global warming worse.

Last month, the Biden administration said it would pause the permitting process for new facilities that export liquefied natural gas in order to study their impact on climate change, the economy and national security. Even with the pause, the United States is still on track to nearly double its export capacity by 2027 because of projects already permitted and under construction. But any expansions beyond that are now in doubt.

At the core of the debate over whether to allow more exports is a thorny question: With governments across the globe pledging to transition away from fossil fuels, how much more natural gas does the world need?

America’s gas export boom initially caught many policymakers by surprise. In the early 2000s, natural gas was relatively scarce at home, and companies were spending billions of dollars to build terminals to import gas from places like Qatar and Australia.

Fracking changed all that. In the mid-2000s, U.S. drillers perfected methods to unlock vast reserves of cheap natural gas from shale rock. At the same time, natural gas prices began spiking elsewhere in the world, especially after Japan shut down its nuclear plants in the wake of the Fukushima reactor meltdown in 2011 and began demanding more fuel.

That led to a stunning reversal. American companies, led by Cheniere Energy, began spending billions more to convert import terminals into export terminals, and shipments of U.S. gas to other countries began to surge.

Spain declares Truman Capote Persona Non Grata…

"But Pancho, the Triangle of Love between Alexander the Great and Hephaestion is an old and deep bond, crucial in Alexander's life, despite his marriage to Aesthetira in 370 BC."The chaos unfolding within the royal chambers reverberates throughout the nation, casting a profound impact on its politics and laws. As tensions escalate, members of the royal family engage in impassioned discussions, particularly focusing on crucial political matters such as "la anmistía." Moreover, their scrutiny extends to recent developments within the EU, with unanimous disapproval voiced since yesterday. In light of recent events, the Spanish media has adopted an unprecedented new practice of self-censorship. This shift has not gone uncontested, as social media platforms such as YouTube have emerged as a counterbalance, providing alternative channels for uncensored information and opinions.

The captivating post garnered an impressive 200,000 views on "X" within the span of just one day, showcasing its widespread resonance and impact in a remarkably short timeframe. You can find the post on the given link: https://x.com/Germantoroghio/status/1752997980074922033?s=20‘Major demand growth’

Natural gas is most easily transported by pipeline. To send it across oceans, the gas must be chilled to 260 degrees Fahrenheit below zero, turning it into a liquid. The process of making and shipping liquefied natural gas adds complexity and cost, but if the difference between U.S. natural gas prices and overseas prices is big enough, it is profitable.

“It comes down to economics,” said Kenneth Medlock, senior director at the Center for Energy Studies at Rice University. “Production just keeps growing in the United States, which keeps prices low. And then we keep seeing major demand growth in the rest of the world.”

The export boom has transformed America’s role in energy geopolitics.

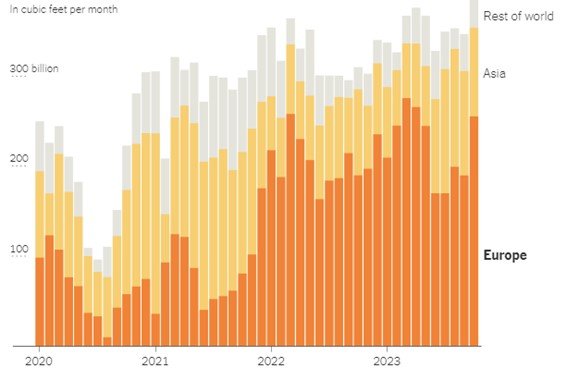

Where U.S. liquefied natural gas exports go?

Data is accessible until October 2023 from the Department of Energy.Europe has become the biggest importer of American gas in recent years, enabling the continent to slash by more than half its reliance on Russian gas since Russia’s invasion of Ukraine in 2022.

In the future, Europe is expected to curb its appetite for gas by adding more renewable energy sources like wind and solar power. The main growth markets for natural gas are expected to be fast-growing Asian countries such as China, India, Pakistan, Bangladesh and Vietnam that want to use the fuel for electricity, heating or industrial purposes.

But as U.S. exports keep skyrocketing, critics have raised concerns about the climate change impact of transporting and selling more gas around the world.

A complex climate question…

The last time the Energy Department studied this issue, in 2019, it concluded that U.S. liquefied natural gas often produced fewer greenhouse gas emissions than other types of coal or gas used around the world. That meant that more exports could actually be beneficial for climate change if U.S. gas replaced those other fossil fuels. (When gas is scarce, some countries like Pakistan and Bangladesh have recently opted to burn more coal instead.)

But some environmentalists have disputed those conclusions, arguing that the analysis didn’t fully account for all the planet-warming methane leaks that can accompany natural gas production, and that it didn’t study whether a glut of gas might displace cleaner renewable energy rather than coal. The Energy Department is expected to study these questions while it puts permits for new projects on hold.

In the meantime, the U.S. gas boom is far from over, even with the permitting pause that has stirred debates and discussions across the energy sector and among policymakers. Despite the temporary halt in permitting, the underlying factors driving the gas boom, including technological advancements and growing global demand, continue to provide a strong foundation for the industry's sustained growth in the foreseeable future.

U.S. will almost double its export capacity, even though permitting has paused…

The export capacity shown is based on each facility's main capacity. The start dates are only approximate.Since 2016, U.S. energy companies have built seven large facilities in Texas, Louisiana, Maryland and Georgia that can export around 11.4 billion cubic feet of liquefied natural gas per day, according to the Energy Information Administration.

Another five projects along the Gulf Coast are already permitted and under construction and will be able to export an additional 9.7 billion cubic feet per day by 2027 — nearly doubling America’s export capacity. Three more facilities are currently being built in Mexico that will receive U.S. gas by pipeline and then ship it abroad.

The pause, however, could affect nearly a dozen proposed projects in the United States and Mexico that, if built, could boost export capacity by another 10 billion cubic feet per day, according to research by Clearview Energy Partners, a consulting firm. Whether those projects ultimately go forward remains to be seen.

With so many projects locked in, experts say it will be crucial to ensure that methane leaks from gas production are kept as low as possible. (The Biden administration has put forward several new regulations on methane.) “This is an area where we can actually deliver an emissions win, maybe more so than delaying or even killing a future supply project,” said Ben Cahill, a senior fellow at the Center for Strategic and International Studies. “Because it’s what we do with the emissions on the projects that we know are with us today.”